Blog

Articles, announcements, feature updates, and technical posts about all things fintech and payment operations - written by the Payable team.

Financial Automation

07 Aug 2024

Prior to launching Payable, I built platform and marketplace payments at Checkout.com. Picture this a seller in one country, a buyer in another, and a marketplace connecting them—taking a cut. This experience opened my eyes to fintech infrastructure. The Fintech Trifecta: Cheaper, Faster, Simpler Fintech revolves around moving money efficiently. Venture capital investment theses in fintech universally revolve around three core principles: cheaper, faster, and simpler solutions. Whether it's c

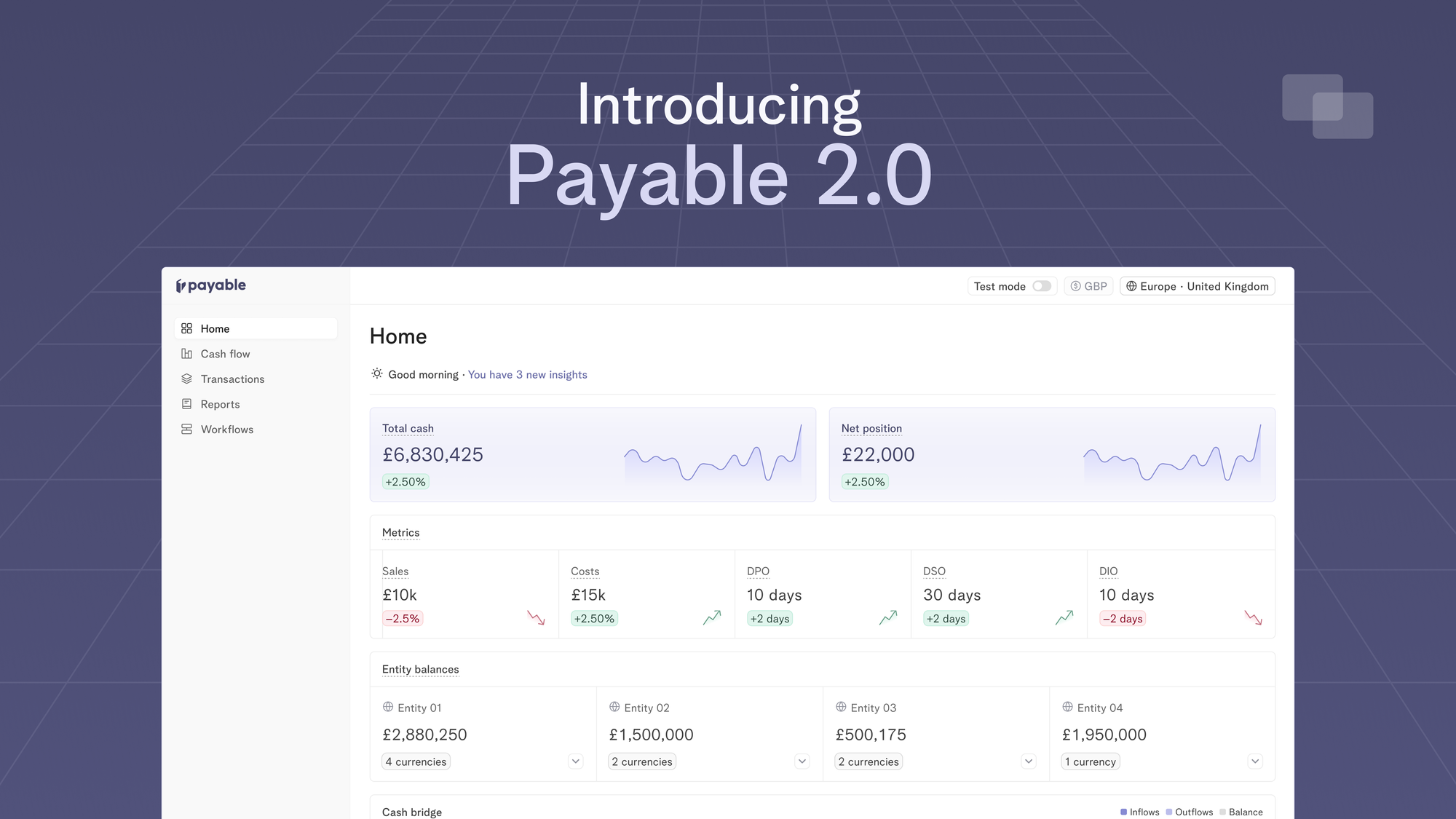

Announcements

Introducing Payable 2.0 - one platform to optimise working capital, make fast liquidity decisions and move your cash metrics in real-time

13 Apr 2024

Today, we’re excited to launch Payable 2.0 which is our evolution to a more connected, intelligent and automated platform for finance teams to track their cash flows in real-time.

Cash Management

Mastering 13-week direct cash flow forecasts

26 Mar 2024

Knowing how your cash flow will behave in the future is crucial for the success and sustainability of any company. One way to achieve this is through the use of a 13-week direct cash flow forecast, which provides a detailed projection of a company's inflows and outflows over a specific time period.

Cash Management

What to keep in mind when preparing daily cash position report for multiple entities and currencies

29 Feb 2024

If you've ever experienced the panic of opening an operating cash flow or bank account and realising you might miss your payroll, then chances are, you understand the importance of accurate and timely cash reporting.

Cash Management

Managing cash flow in a high-interest rate environment

28 Feb 2024

If you are an operator or are responsible for Finance in a startup or a scaleup that has recently secured funding, your primary concern is likely not running out of cash. Instead, you're focused on putting it to good use in the most efficient way possible.

Reconciliation

Journal entry II: Reconciliation in Scaleups

12 Dec 2023

Two of the most pressing challenges that scaling businesses must overcome are inefficient processes and time management. As a business scales, what were once minor inconveniences become magnified, having a ripple effect across the whole business

Managing client money? Here’s how PSD3 will change your financial operations

30 Nov 2023

The payment industry is changing quickly in light of PSD3. And while a definite timeline for PSD3 is yet to be announced, one thigh is clear - it will shake things up once again. Read on to learn more what PSD3 means for you and what operational challenges it brings along.

Reconciliation

Journal Entry I: What is bank reconciliation?

28 Nov 2023

The term bank reconciliation is the process of comparing and verifying bank records with a company’s record of transactions (also called a journal entry). Some refer to this as the financial close process.

Treasury

Bank connectivity series: Deep dive into host-to-host connectivity

24 Oct 2023

For many businesses, H2H connectivity is the key to automating their treasury and financial operations. It allows to exchange financial data with banks in real time, making it easier to manage liquidity, monitor cash flows, and make informed financial decisions.

Announcements

Scale your money movement with clever risk controls

17 Oct 2023

Our Payments automation module automates your payment instructions directly from Payable. We connect with your bank and ERPs so you can easily automate vendor payments without building and maintaining complex integrations.

Treasury

Bank connectivity series: Comparing host-to-host, EBICS, APIs, and Open Banking

12 Oct 2023

Bank connectivity keeps the money moving and lets companies pay their bills, get paid, and do all their financial tasks more efficiently. We’ll break down and compare four common bank connectivity options: Host-to-Host, EBICS, APIs, and Open Banking.

Team Payable

My experience as an engineering intern at Payable

11 Oct 2023

Hi, I’m Boris, I was doing my final year of high school this summer when I joined Payable as a Software Engineering Intern building an ROI calculator for their website.

Announcements

A/P Reconciliation: Keep your payables in check, automatically

30 Aug 2023

Reconciliation has always been a headache for finance teams. It is essential to track your expected payments and bills for effective cash flow management and planning - working out which vendor you need to pay and when.

Reconciliation

Why using ERPs for bank reconciliation doesn’t scale

17 Aug 2023

As businesses scale, it becomes more difficult for teams to communicate and collaborate effectively. They use separate systems, processes and software that creates data silos across the business.

Treasury

Treasury management: Key functions, benefits & best practices

10 Aug 2023

Treasury management is more critical than ever in a constantly evolving business landscape. Especially after the global pandemic, companies are exploring ways in which they can better equip back-office teams to navigate financial uncertainty and gain competitive advantage.

Customer Stories

How Payflow ditched spreadsheets to automate payment operations with Payable

06 Aug 2023

Payflow scaled finance function with Payable automating 40% of manual tasks and unlocking 30% of working capital with automated reconciliation.

Team Payable

Building a foundation for success: 5 lessons from late-stage companies for early-stage startups

31 Jul 2023

I joined Payable after I had worked at a fintech TrueLayer, that had grown to scale, and as part of that journey, I learned some lessons I vowed to bring with me on my new adventure.

Reconciliation

How to fully automate Xero bank reconciliation

27 Jul 2023

Unfortunately, relying on Xero to automate month-end close will be a challenge, but not all is lost, as there are other ways that make Xero work harder for finance teams.

Announcements

Automate NetSuite reconciliation with Payable

27 Jul 2023

We are excited to announce our new integration with NetSuite, which will revolutionise the way finance teams manage their financial operations.

Reconciliation

How payment references impact reconciliation match rate

26 Jul 2023

When a business receives payments from customers or clients, they need to ensure that each payment can be correctly identified and associated with the specific invoice or record it corresponds to. The reconciliation match rate indicates how well a company is able to achieve this accurate matching.

Announcements

Automate reconciliation with Xero integration

25 Jul 2023

You can now integrate Xero with Payable and fully automate your reconciliation process from start to end. Save hours (even days!) when preparing financial statements and closing books each month.

Cash Management

Cash management: Effective strategies for financial success

25 Jul 2023

Efficient cash management involves optimising the use of available funds, maintaining adequate liquidity, and making informed decisions to ensure a healthy financial position.

Announcements

Automate end-to-end reconciliation with Payable Integrations

18 Jul 2023

We are excited to introduce Payable Integrations - the essential connecting layer between bank transactions and finance tools.

Banking with SVB UK? What you need to know as you migrate to HSBC Innovation Banking

07 Jul 2023

If your business was banking with SVB UK you need to prepare for transitioning to HSBC Innovation Banking. We have summarised the latest guidance from HSBC Innovation Banking and what to keep in mind as you navigate the process.

Reconciliation

Automated Reconciliation: scale payment operations with ease

27 Jun 2023

Bank reconciliation just got easier! Payable provides intelligent reconciliation for finance teams with automated matching, reporting and clever workflows for conflict resolution.

Accounts Receivable

Automating accounts receivable management: guide for finance leaders

23 Jun 2023

Accounts receivable, or A/R for short, is the core pillar of financial management, ensuring that businesses can navigate their liquidity and cash flow. Inefficient accounts receivable management can often become a significant bottleneck for businesses ability to scale.

Team Payable

Our mission to change treasury management

14 Jun 2023

Last month we celebrated our 1st anniversary since launching Payable, which made us reflect on our journey, why we started Payable and what the future holds.

Announcements

Cash visibility with Automated Reconciliation

13 Apr 2023

You can add all your banking partners to Payable and have real-time cash visibility across all your currencies. Instantly know exactly who has paid you what with automated reconciliation. Track all your customer and supplier account balances in real-time.

Payments 101

3 key banking APIs for treasury

13 Mar 2023

In the last post, we explored banking APIs and how bank connectivity is key for a company to successfully scale. As corporate banking customer, there are a few different API types that will 10X your operations as a payments or treasury team. Here we will deep dive into what they are and how they will benefit your business. Payment Initiation API You want to pay your customers, suppliers and users in the most efficient way, but before leveraging a banking API payment operators often depend on

Payments 101

Buy vs build - what to do?

06 Mar 2023

It is a recurring question for any company scaling or expanding; to solve a problem should I buy some software or build it in house? It is a tough question that requires deliberation.

Payments 101

Bank Connectivity - how banking APIs can save you money

28 Feb 2023

Bank connectivity in treasury terms refers to the ability of an organisation to connect and interact with its banking partners. This can include accessing bank account balances and transaction data in real-time, plus initiating and tracking payouts.

Engineering

Payments 101

From experiencing the problem, to building the solution: An engineer's point of view

23 Feb 2023

Finding Product Market Fit Companies form to solve a customer problem. Whether that is to innovate how loan finance happens or to disrupt the retail investing landscape. The primary focus of these startups is to prove they have Product Market Fit (PMF) early, rather than to engineer the optimal backend operation systems. Manual processes are frequent and acceptable, as the focus on the small engineering teams is to build what the customers directly interact with. After all, without customers u

Introduction to Payment Operations

15 Feb 2023

Payment Operations is the process of tracking, reconciling, and moving money across your business. Today, this actually happens through spreadsheets, bank files, and legacy protocols like SFTP. 0:00 /2:37 1× When a company reaches a certain level of complexity, payment operations becomes a pain point. The company requires multiple bank accounts and multiple payment providers across different geographies. Let me walk you through why that's happening -

Payment operations for B2B lending companies

31 Jan 2023

Business-to-business lending has become a lot more exciting in the past few years, moving from one-size-fits-all to being tailored to what businesses really need. For daily operations we’ve seen the proliferation of Buy Now Pay Later and embedded finance options at checkouts, which give businesses the freedom to control their cash flow and make one off purchases without going into their overdraft. For companies considering the next stage of growth, revenue based financing allows businesses to

Engineering

Building developer friendly APIs

19 Jan 2023

APIs are the key ingredient in scaling a technology company's engineers and clients. A developer friendly API can help engineering teams benefit from each other’s work without ever needing to schedule a meeting.

Team Payable

From Steel Structures to Data Structures

25 Oct 2022

Preface Let me start by admitting that as an Engineer, I’m not much of a writer. In fact, I have never written a blog post or published an article in my life, but we all have to start somewhere. I hope this post is interesting and informative, but if nothing else, I hope it will help readers avoid the mistakes I made when faced with similar crossroads in their careers. Depending on the reception and reader interest, I’d like for this to be the first in a series of articles documenting the steps

News

We've raised $6.1M to modernise business payments

11 Oct 2022

We've raised $6.1M to build a payment operations platform so companies stop using EBICs, bank files and spreadsheets to move and reconcile money. 💡With Payable, you can connect your banks and automate payments from initiation to reconciliation with a single API and dashboard. About a year ago, Raz and I sat down with the treasury and payment operations team at Checkout.com to understand what it would take us to launch the new marketplace solution. We realised that tech companies depend on cl

Engineering

CTO diaries - building an engineering function from the ground up

10 Oct 2022

Hey! I am Raz, and this post is a part of a series of posts to share my experience and journey with other engineers considering either joining an early-stage start-up or aspiring to reach the role of a CTO. Over the last couple of years, I worked for a great company in a well-paid job with fantastic career progression, from hands-on responsibilities to management. I never thought I would seek something else, especially taking such a massive risk later in my career. After so many years in the i

Payable: Payment Operations Software

23 Sep 2022

Companies expend huge amounts of effort and money building payment operations. Today, treasury and finance teams have to become quite large to manage their payments. This is not just a problem for traditional organisations - we’ve heard this is happening everywhere from listed companies to start-ups. They are using a tangled web of spreadsheets to track and make payments. That’s insane. Look, there are 8k+ Payment Operations Jobs just in the UK, and 80 added every week. Trillions of dollars t