Two of the most pressing challenges that scaling businesses must overcome are inefficient processes and time management. As a business scales, what were once minor inconveniences become magnified, having a ripple effect across the whole business. This is certainly true when it comes to your finance team’s reconciliation process.

Join us for the second part of our reconciliation series as we put scaling businesses under the microscope and explore how effectively scaling financial operations will help you lead your company through growth.

New to reconciliation in scaleups? Head to our first article explaining bank reconciliation, best practices and different reconciliation processes in finance operations.

Reconciliation challenges in scale-ups

Reconciling two sets of records becomes a whole lot more challenging as a business scales, with new obstacles to contend with that simply weren’t there before. We’ve outlined the key challenges in reconciliation that scale-ups face and provide insights on how to overcome them.

- Rapidly growing transaction volumes

As your business grows, so do your transactions, both incoming and expenses. With more transactions to reconcile, the potential for errors and confusion grows, and the time needed to complete the bank reconciliation process increases. The need to reconcile more frequently for cash flow management and meet increased reporting requirements can add hours (if not days) to finance controllers’ workload.

- Expanding product lines

Entering new markets or expanding product or service offerings is often high on the agenda for scale-ups. These advancements result in a growing number of suppliers, partners and vendors, all of whom need to be paid on time. They also translate into higher costs of doing business. For these reasons, transaction reconciliation becomes even more vital as does enhanced transparency of data.

- Managing multiple currencies

Delivering services or goods on a global scale inevitably involves handling multiple currencies. From receiving customer funds to making payouts to suppliers in local currencies, scaling businesses must navigate the complexities of reconciling financial records in multiple currencies as well as effectively managing time stamps.

- Complex intercompany relationships

Businesses that begin as a single entity usually go on to establish international legal entities in other countries as they scale and enter global markets. This in turn creates a more complex company structure, and as we saw in Part 1 of this reconciliation series, adds a new level of complexity and regulatory compliance. The bottom-line is that multi-entity accounting requires a cohesive and streamlined solution to deliver the more complex outputs required.

- Integrating disparate systems

Companies transitioning from startup to scale-up must streamline their operations to achieve efficiencies. This involves integrating disparate systems, for example accounting software and expense management tools, and automating manually-intensive tasks. From paying salaries and employee expenses to holding multiple currencies, finance teams have to find optimal ways to navigate the growing complexity of financial operations in scale-ups.

Technology and automation in reconciliation

Increasingly powerful technology and automated systems present an invaluable opportunity for scale-ups. Leveraging the right reconciliation tools provides financial teams with increased transparency, efficiency and time savings. The ROI of these gains have far-reaching benefits across the financial close process, including helping to prevent fraud, reduce time-consuming and tedious tasks, and facilitate accurate and correct audit trails.

Why use finance automation when scaling?

Using Excel spreadsheets to run the reconciliation process may have sufficed in the early days, but as a company scales, finance teams must overcome obstacles like increased financial risk, regulatory issues and access to capital.

To help solve these challenges, scale-ups are leveraging reconciliation software, AI-powered tools and data analytics. That’s because they deliver a broad spectrum of benefits to scaling businesses, including:

- Improved accuracy

- Heightened efficiency

- Enhanced scalability

5 Practical recommendations for identifying solutions for your finance team

- Identify your core challenges; talk to your team to find out what’s sapping their time, what issues are hindering your financial operations and where improvements could be made.

- Define the problem; encapsulate your pain points and decide what you want to achieve by overcoming these.

- Do your research; business leaders are more open about the challenges they’ve faced than ever before. LinkedIn posts, blog articles, podcast interviews and fireside chats are all great sources of solutions.

- Leverage technology; there are plenty of powerful, automation-based platforms on the market designed for scale-ups to enhance efficiencies, reduce costs and facilitate growth.

- Think about now and tomorrow; As a scaling business, you need to identify solutions that will meet the needs of your reconciliation activities both today and in the future, so consider how your company growth will impact these.

Best practices for reconciliation in scale-ups

Let’s be honest about the reality of a business deep into its growth journey. Challenges appear from nowhere, and while solving them is exciting, the learning curve is steep. To help you, we’ve outlined five key best practices for reconciliation in scale-ups

- Establish robust internal controls

Internal controls act as an enabler for finance transformation. Benchmark your business’ current internal controls; how reliable, consistent and standardised are they? Internal controls should be well-designed, implemented, documented, monitored and optimised to help reduce risk, improve accuracy, reduce wasted time and lower costs. - Implement segregation of duties

As a business scales, it’s vital to review the responsibilities and controls that individuals have over business processes. Having a single person with responsibility for, for example, handling and recording inventory transactions or posting a journal entry into your general ledger increases internal risks for your business. Implementing robust segregation of duties in financial operations helps businesses to minimise exposure to risk, from cybercrime threats to regulatory compliance. - Leverage automation tools and technology

Automating tasks using tools and technologies streamlines a scale-up's operations, improving efficiency and productivity. This enables scaling businesses to remain agile during periods of growth. Harnessing technology can be as simple as switching to cloud computing to more complex capabilities like leveraging cutting-edge AI to speed up and automate business processes. Reconciliation software in particular allows businesses to process greater volumes of transactions without compromising speed or accuracy. - Maintain clear documentation

Documenting reconciliation processes acts as an important tool to help startups scale more easily. As a business expands, so do the number of moving parts, creating new levels of complexity. Standardising reconciliation processes and formalising common procedures that you know already work acts as recipes for scaling finance teams to refer to. This streamlines efficiency, makes it easier to train new employees as the company grows, and helps reduce the risk of compliance breaches. - Review regularly

Just like in startups, being in a state of flux while scaling is not uncommon. This can make it tempting to avoid reviewing your reconciliation processes. But regularly scrutinising your processes, procedures, segregation of duties and compliance measures in relation to reconciliation will unlock hidden opportunities to optimise your reconciliation operations and create added value that will benefit the entire company.

Summary

Growing transaction volumes, expanding product lines, multiple currency management, complex intercompany relationships and integrating disparate systems present significant challenges for businesses transitioning from startup to scale-up.

The ability to overcome these obstacles by establishing and maintaining robust internal controls and processes, leveraging automation tools and technology and conducting regular reviews allows finance teams to transform the reconciliation process into a driver for growth while mitigating risk and opening doors to opportunities.

Announcements

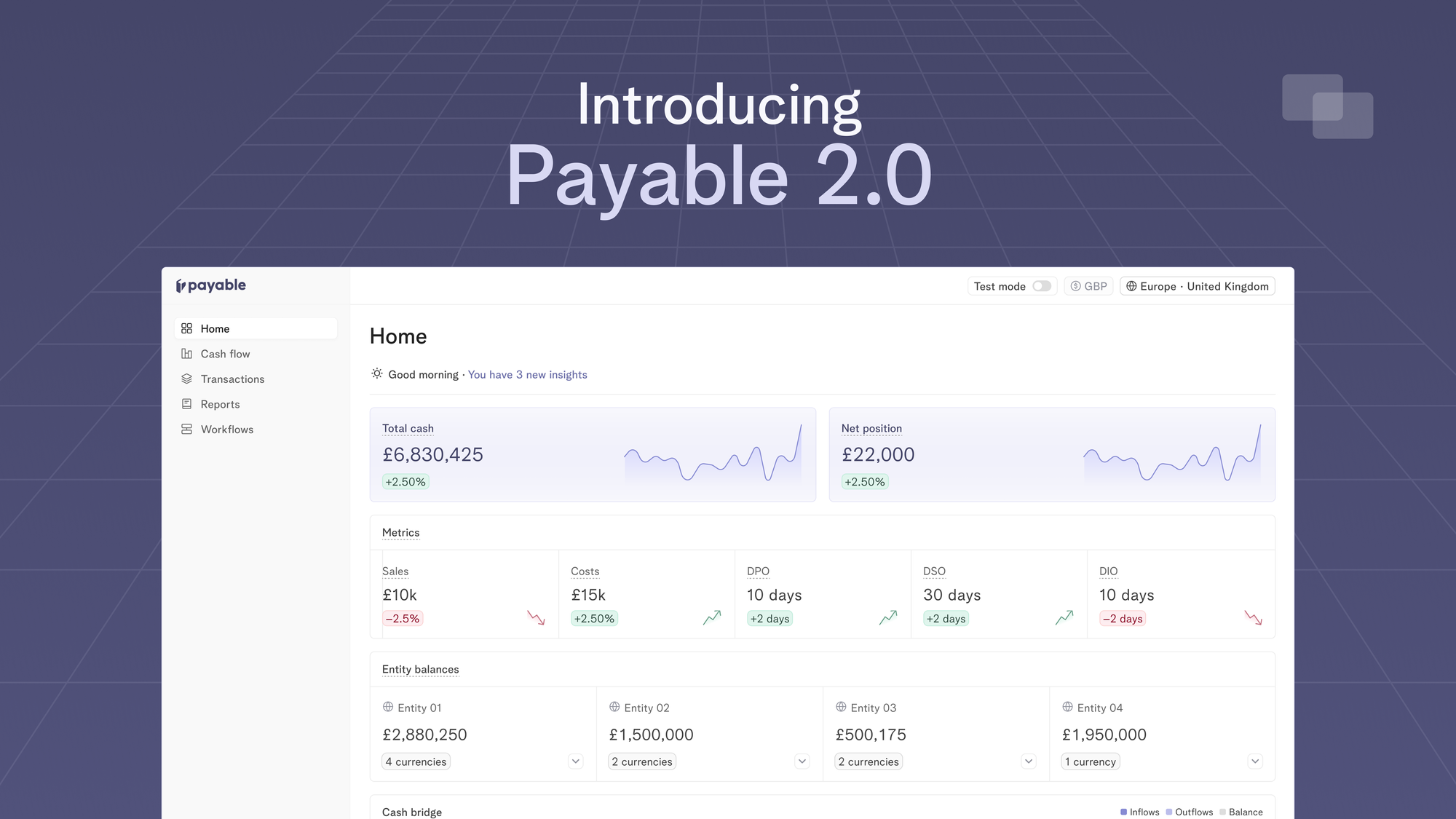

Introducing Payable 2.0 - one platform to optimise working capital, make fast liquidity decisions and move your cash metrics in real-time

13 Apr 2024

Today, we’re excited to launch Payable 2.0 which is our evolution to a more connected, intelligent and automated platform for finance teams to track their cash flows in real-time.

Cash Management

Mastering 13-week direct cash flow forecasts

26 Mar 2024

Knowing how your cash flow will behave in the future is crucial for the success and sustainability of any company. One way to achieve this is through the use of a 13-week direct cash flow forecast, which provides a detailed projection of a company's inflows and outflows over a specific time period.