Knowing how your cash flow will behave in the future is crucial for the success and sustainability of any company. One way to achieve this is through the use of a 13-week direct cash flow forecast, which provides a detailed projection of a company's inflows and outflows over a specific time period.

Understanding the importance of 13-week cash flow forecasting

Effective cash flow management is vital for any business. Cash is the lifeblood of a company, allowing it to meet its financial obligations and invest in growth opportunities. By accurately forecasting cash flow, businesses can anticipate potential cash shortages and take appropriate measures to mitigate them. A 13-week cash flow forecast provides a short-term outlook that allows businesses to make informed decisions regarding their financial strategies.

The role of cash flow in business management

Cash flow represents the movement of money in and out of a company. It includes both the cash generated from operations, such as sales or services rendered, and the cash paid out for expenses, such as rent, salaries, and supplies. Monitoring and managing cash flow is essential as it impacts a company's ability to pay its bills on time, invest in growth opportunities, and meet its financial obligations.

Understanding the nuances of cash flow can also help businesses identify trends in their financial performance. By analysing cash flow patterns, companies can gain insights into their operational efficiency, revenue cycles, and expenditure management. This detailed understanding can inform strategic decision-making and optimise resource allocation for long-term sustainability.

Why 13 weeks? The rationale behind the time frame

The choice of a 13-week time frame for cash flow forecasting is strategic. It provides a short enough period to allow for a detailed projection while also offering flexibility to adapt to any changing circumstances. This time frame is often used as it aligns with quarterly financial reporting and allows businesses to assess their short-term financial health accurately.

The 13-week horizon enables businesses to focus on immediate cash flow concerns and address any liquidity issues promptly. By breaking down the forecast into smaller intervals, companies can pinpoint potential cash crunches and implement proactive measures to maintain financial stability. This proactive approach to cash flow management can enhance resilience in the face of economic uncertainties and ensure sustainable growth in the long run.

The basics of direct cash flow forecasting

Direct cash flow forecasting is a method that focuses on the inflows and outflows of cash based on actual transactions, making it a more accurate and reliable approach. It takes into account the historical cash flow patterns of a business and uses that data to forecast future cash movements.

Understanding the intricacies of direct cash flow forecasting is essential for businesses looking to manage their finances effectively. By analysing past cash flow data and translating it into projected cash inflows and outflows, companies can gain valuable insights into their financial health and make informed decisions about resource allocation and budgeting.

Defining direct cash flow forecasting

Direct cash flow forecasting involves analysing past cash flow data and translating it into projected cash inflows and outflows. This approach takes into account specific revenue and expense items and their timing to provide a comprehensive and precise cash flow projection.

Moreover, direct cash flow forecasting enables businesses to anticipate potential cash shortages or surpluses, allowing them to proactively address any financial challenges that may arise. By identifying trends and patterns in cash flow, organisations can better plan for capital expenditures, debt repayments, and other financial obligations.

Key components of a cash flow forecast

A direct cash flow forecast typically includes several key components. These include projected cash inflows, such as sales revenue, loan proceeds, or investment income, as well as projected cash outflows, such as rent, salaries, and operating expenses. Other components may include expected cash from financing activities, such as loans or equity investments, and changes in cash balances.

A detailed cash flow forecast can serve as a valuable tool for monitoring and evaluating business performance over time. By comparing actual cash flow data to forecasted figures, companies can assess their financial management practices and make adjustments to improve cash flow efficiency and profitability.

Steps to create a 13-week direct cash flow forecast

Creating a 13-week direct cash flow forecast involves several steps, each of which plays a crucial role in ensuring its accuracy and effectiveness. Developing a comprehensive cash flow forecast is not just about crunching numbers; it requires a deep understanding of the business's financial health and the factors that influence its cash flow. By following a structured approach and paying attention to detail, businesses can gain valuable insights into their short-term liquidity and make informed decisions to manage their cash effectively.

- Gathering necessary financial data

The first step in creating a cash flow forecast is to gather all the relevant financial data. This includes historical cash flow statements, income statements, and balance sheets. Additionally, it is essential to include any anticipated changes in revenue or expenses that might impact cash flow over the forecast period.

Examining historical financial data provides a baseline for understanding past cash flow patterns and identifying trends that can help in forecasting future cash flows. By analysing both internal financial records and external market data, businesses can create a more robust forecast that takes into account various economic factors and industry-specific conditions. - Projecting income and expenses

Once the financial data has been collected, it is time to project income and expenses for the forecast period. This can be done by analyzing historical trends, considering seasonality and market conditions, and making educated assumptions about future revenue and costs. It is crucial to be thorough and detail-oriented during this step to ensure accurate projections.

Forecasting income and expenses requires a blend of quantitative analysis and qualitative judgment. Businesses need to factor in not only the expected sales figures and operating costs but also external variables such as regulatory changes, competitive pressures, and technological advancements that could impact cash flows in the coming weeks. - Calculating the cash flow

After projecting income and expenses, the next step is to calculate the cash flow. This involves subtracting cash outflows from cash inflows to determine the net cash flow for each period within the forecast. It is important to review the calculations carefully, taking into account any potential discrepancies or inaccuracies.

Accuracy in calculating cash flow is paramount for businesses to make informed financial decisions and allocate resources effectively. By conducting sensitivity analyses and scenario planning, organisations can assess the impact of different variables on their cash flow projections and develop contingency plans to mitigate risks and seize opportunities proactively.

Tips for accurate and effective forecasting

Forecasting cash flow is not a one-time task; it requires regular updating and adjustment to remain accurate and relevant. Here are some essential tips to enhance the accuracy and effectiveness of your cash flow forecast:

Regularly updating your forecast

Cash flow can fluctuate based on various factors, such as changes in market conditions or unexpected expenses. To ensure that your forecast remains accurate, it is crucial to update it regularly. This allows you to incorporate any changes in revenue or expenses and make necessary adjustments to your financial strategies. Regularly updating your forecast also enables you to adapt to any new opportunities that may arise. By staying on top of your cash flow projections, you can identify potential areas for growth and allocate resources effectively. This proactive approach can help you make informed decisions and seize opportunities for business expansion.

Incorporating business trends and seasonality

Businesses often experience seasonal fluctuations in cash flow, with certain periods being more profitable than others. By understanding and incorporating these trends into your forecast, you can better anticipate and manage any cash flow challenges that may arise. Analysing historical data and considering market conditions can provide valuable insights into seasonal patterns.

Moreover, incorporating business trends into your forecasting process can help you identify emerging opportunities or threats in the market. By monitoring industry trends and consumer behaviour, you can adjust your forecast to align with changing market dynamics. This proactive approach can give you a competitive edge and position your business for long-term success.

Overcoming common challenges in cash flow forecasting

Cash flow forecasting is not without its challenges. However, by being aware of these challenges and implementing strategies to overcome them, businesses can enhance the accuracy and reliability of their forecasts.

Dealing with uncertain income and expenses

One of the major challenges in cash flow forecasting is dealing with uncertain income and expenses. Market conditions, customer behaviour, and unexpected events can all impact cash flow significantly. To mitigate this challenge, it is important to conduct thorough market research, establish contingency plans, and regularly review and adjust your forecast based on new information.

For example, when conducting market research, businesses can analyse historical data, industry trends, and customer behaviour to gain insights into potential fluctuations in income and expenses. By understanding these patterns, businesses can make more accurate forecasts and allocate resources accordingly.

In addition, establishing contingency plans can help businesses navigate unexpected changes in cash flow. This can involve setting aside a portion of revenue as a buffer, diversifying income streams, or negotiating flexible payment terms with suppliers and customers. By having these plans in place, businesses can better adapt to unforeseen circumstances and maintain a steady cash flow.

Handling unexpected cash flow disruptions

Another common challenge is handling unexpected cash flow disruptions. This can include delayed payments from customers, unexpected equipment breakdowns, or economic downturns. To minimise the impact of these disruptions, businesses should establish emergency funds, maintain good relationships with suppliers and customers, and closely monitor cash flow to identify and address issues promptly.

Having emergency funds can provide a safety net during times of cash flow disruptions. By setting aside a portion of profits specifically for emergencies, businesses can ensure that they have the necessary resources to cover unexpected expenses or bridge gaps in income. This can help prevent cash flow shortages and maintain financial stability.

Maintaining good relationships with suppliers and customers is also crucial in managing unexpected disruptions. By fostering open communication and building trust, businesses can negotiate payment terms, request extensions, or explore alternative solutions when faced with cash flow challenges. These relationships can be valuable in times of need and can help businesses navigate through difficult periods.

Furthermore, closely monitoring cash flow on a regular basis is essential in identifying and addressing issues promptly. By using cash flow management tools or software, businesses can track income and expenses in real-time, allowing them to spot any discrepancies or potential disruptions early on. This proactive approach enables businesses to take immediate action, such as following up on overdue payments or adjusting spending, to mitigate the impact on cash flow.

In conclusion

While cash flow forecasting presents its fair share of challenges, businesses can overcome them by implementing effective strategies. By conducting thorough market research, establishing contingency plans, maintaining good relationships, and closely monitoring cash flow, businesses can enhance the accuracy and reliability of their forecasts. This, in turn, enables them to make informed financial decisions and navigate through both expected and unexpected changes in cash flow.

Financial Automation

07 Aug 2024

Prior to launching Payable, I built platform and marketplace payments at Checkout.com. Picture this a seller in one country, a buyer in another, and a marketplace connecting them—taking a cut. This experience opened my eyes to fintech infrastructure. The Fintech Trifecta: Cheaper, Faster, Simpler Fintech revolves around moving money efficiently. Venture capital investment theses in fintech universally revolve around three core principles: cheaper, faster, and simpler solutions. Whether it's c

Announcements

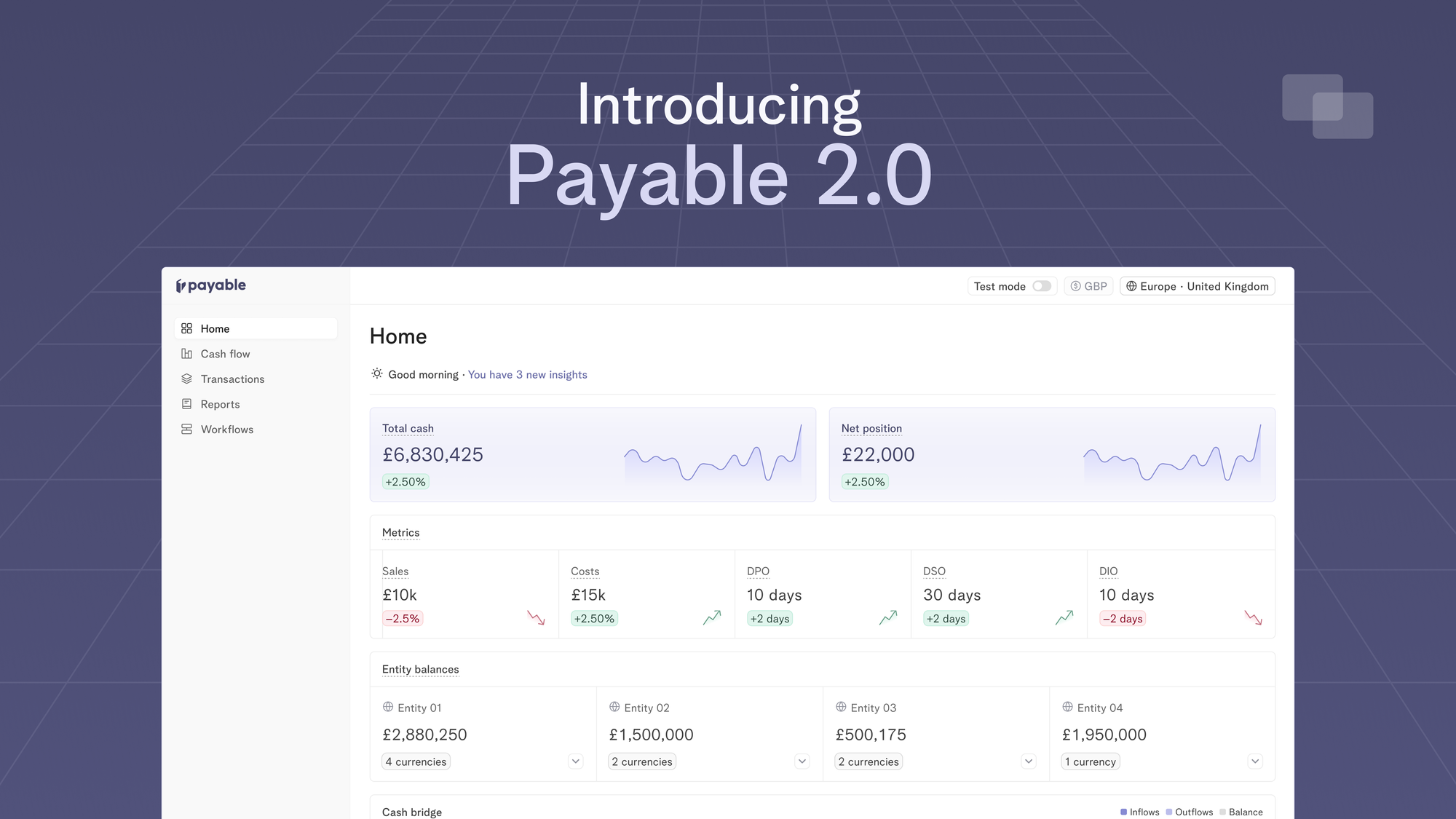

Introducing Payable 2.0 - one platform to optimise working capital, make fast liquidity decisions and move your cash metrics in real-time

13 Apr 2024

Today, we’re excited to launch Payable 2.0 which is our evolution to a more connected, intelligent and automated platform for finance teams to track their cash flows in real-time.