SVB UK was acquired by the HSBC bank in the UK and is currently taking steps to migrate all of its customers to HSBC systems under its new brand HSBC Innovation Banking. If you were banking with SVB UK, you need to prepare for this transition and minimise the disruption to your business. We have summarised the latest guidance from HSBC Innovation Banking and what to keep in mind as you navigate through the process.

Latest facts and important dates:

- HSBC Innovation Banking account details become operational from 7th August 2023 and your existing account details are no longer valid after 4th August 2023, 5pm.

- On 7th July HSBC Innovation Banking sent Notice Letter and Guide to Changes outlining changes to terms and conditions, tariffs, products and services.

- HSBC Innovation Banking are waiving account fees for six months, excluding card fees, overdraft and fees related to lending products.

- HSBC Innovation Banking terms and conditions come into effect on 7th August 2023. Terms for card products (Business Charge Cards and Virtual Cards) will be effective from the date you start to incur card transactions or 29th July 2023, whichever is earlier.

- SVB Online Banking, SVB Transact Gateway, Business Charge Cards and Virtual Cards will be discontinued, with new HSBC services available instead.

- Payments sent to your deactivated SVB UK account will be redirected to your new HSBC Innovation Banking account for some time.

- New debit cards will be sent before 31 July 2023 and available for use from 7th August 2023.

As of recent, SVB UK customers have started to receive communication from the newly rebranded HSBC Innovation Banking teams outlining “what is going to happen next” leaving its readers with more questions than answers.

So let’s dive in and unpack the details.

What changes can SVB UK customers expect when moving to HSBC Innovation Banking?

Over the next eight weeks, HSBC Innovation Banking will issue new account details, and switch all the payments, balances, beneficiaries, and payment templates to its new systems. To help with the transition, HSBC Innovation Banking has sent a list of changes customers can expect when migrating from SVB UK:

- SVB UK Online Banking will switch to HSBCnet

Customers will be moved from SVB UK Online Banking to HSBCnet. All beneficiaries and payment templates in your usual SVB UK Online Banking will also be migrated to HSBCnet. Any payment templates listed as being in a ‘Pending Approval’ status on either the UK Templates List or the Cross Border Templates List will not be moved to HSBCnet.

- Customers will receive new account details

HSBC Innovation Banking uses HSBC’s global banking network and therefore your account details will change. Your SVB UK bank details will be replaced with account details tied to HSBC Innovation Banking. Similarly, for EUR payments, you will be given new IBAN account details as well as SWIFT BIC codes. Your updated account details will be operational from 7th August 2023 and your existing account details with SVB UK will no longer be valid from the close of business on 4th August 2023.

- Customers will receive new payment cards

Customers using debit cards, Business Charge Cards, or Virtual Cards will receive new HSBC Innovation Banking debit cards, Business Charge Cards, and Virtual Cards throughout July. Euro cards will be discontinued from 31st July 2023 and not replaced. You’ll be able to access your new HSBC Innovation Banking cards in a new online platform called MiVision.

- Operational changes to payment channels and services

When new account details become operational on 7th August 2023, payments scheduled at and around the time of the switch will have to be updated to include new account details. If you use SVB Transact Gateway, your payments channel will be moving to a new host-to-host platform called HSBC Connect. There will also be changes to payment cut-off times, cash and check deposits and changes to payment and reporting channels such as Transact Gateway, Bacs Bureau, SWIFT Information Reporting, Open Banking APIs, and Xero OFX Information Reporting Feed.

- Changes to FX and lending services

There are expected changes to foreign exchange and lending services, such as tariff updates and updates to your loan account details with more details coming in due course. Any loan-related payments will have to be sent to a new settlement account.

- Changes to certain account types

The SVB UK Current Account will become a Current Plus Account. From 1st August 2023 HSBC Innovation Banking will no longer offer Standing Instructions, Client Monies Account Evergreen Notice Accounts and Corporate Deposit Client Monies Accounts. An equivalent offer will be available for Client Monies Accounts instead.

How to prepare for transition from SVB UK to HSBC Innovation Banking?

If you were a SVB UK customer, there is no doubt that this transition period will have a significant impact on your business. Here are a few tips to help your business, finance and operations teams prepare for the migration.

1. Access and familiarise yourself with HSBCnet

Your online banking administrators will receive an email from HSBC Innovation Banking with login details to access HSBCnet. During the early access period, the portal will be view-only with limited information. You won't be able to see your transactions or account balances but you’ll have access to your new account details.

2. Notify your payees

Since HSBC Innovation Banking will utilise HSBC global banking network for payment settlement, your account details will change. Prepare a list of payees you will have to inform about the changes to your account details when they become operational from 7th August 2023. They should be ready to use these details from the opening of business on 7th August, but not before. HSBC Innovation Banking will set up payment redirections that will automatically reroute the payments sent to your SVB UK account to your new account. This redirection will be in place for some time after 7th August 2023.

3. Identify your recurring and direct debit payments

Gather a list of your subscriptions or recurring payments set up on existing SVB UK debit cards, Business Charge Cards, or Virtual Cards so that you can be ready to set these up again on your new cards when you receive them. HSBC Innovation Banking will not be setting up any recurring or future-dated payments that previously existed within the UK Services section of SVB Online Banking, you will need to set these up again. Your Direct Debits will be redirected using your updated bank account details and continue to be used for bill payments.

4. Consider diversifying your banking relationships

If there is one thing that we all learned from what happened with SVB is “not to put all our eggs in one basket”. It is worth considering how you can distribute your cash across multiple accounts to lower the risk of exposure and maximise your returns for idle cash. Look for options that fit your business needs. You can close your HSBC Innovation Banking account without charge and/or terminate your access and use of a specific product or service before 29th September 2023.

5. Update your operational systems and processes

Businesses handling large volumes of incoming payments or managing their customers’ cash will have to ensure full visibility of their payment operations to minimise disruption during the account switch.

- Incoming payment redirections: For some time after 7th August HSBC Innovation Banking will set up payment redirections that will automatically reroute the payments sent to your SVB UK account to your new account.

- Open banking APIs: If you access your account data or submit payments from third-party apps using our Open Banking APIs, you’ll need to establish the consents again for your updated HSBC Innovation Banking accounts.

- Xero OFX information reporting feed: If you currently use SVB UK’s automated information reporting feed into Xero, this will not be supported when your new details are on 4th August 2023. Instead, you will be able to link your account to Xero by using Open Banking APIs and authorise in HSBCnet.

- SWIFT Information reporting: You’ll need to provide your updated account details to anyone who receives your SWIFT messages and let them know that the messages will be coming from HSBC’s BIC.

6. Download your historical account statements from SVB UK

HSBC Innovation Banking Team suggests downloading and storing your historical account statements in SVB Online Banking covering the last two years. This is especially important for regulated businesses operating in the financial services space that have compliance obligations. While these statements won't be available on the HSBCnet, customers will be able to access a copy of these records in the future by contacting HSBC.

7. Get set up with HSBC Connect

If your business was previously using SVB Transact Gateway for back-office operations, you will move to HSBC Connect. To get set up, you will have to whitelist HSBC IP addresses on your firewall and connect via SSH authentication as HSBC Connect does not support multi-factor authentication. HSBC Connect also does not have a user interface through which payment approvals can be executed, that will be done via HSBCnet and only for payments in XML format.

What challenges can you anticipate when moving to HSBC systems?

No access to your historical data within HSBCnet

As a result of the migration, you won’t have access to your historical SVB transaction data within HSBCnet. You will have to export this data from SVB online banking, but you will not be able to combine it with your ongoing HSBC data inside the HSBCnet platform. This will impact your ability to easily report on your past performance and historical cash flow.

Changing format for host-to-host reporting and payments with HSBC Connect

Migrating to HSBC Connect from SVB Transact Gateway will likely require significant upheaval both for your engineering team and your entire business. In short, you will have to rebuild your SFTP connection, with changes to whitelisted IP addresses and authentication through new SSH keys that follow HSBC’s specifications. HSBC’s public keys are set to become available to users from some time in July although a date has not yet been communicated. There are also changes in message formatting for transaction reporting and payment origination to support. All in all, we expect that this will take months worth of work for your business to establish a new working connection to HSBC.

No interface and payment approvals for HSBC Connect

HSBC Connect is built as a back office system without a user interface. Compared to SVB Transact Gateway you won’t be able to approve payments from a dashboard. You will only be able to approve payments via HSBCnet, which will add an additional step in your payment operations process and waste the time of senior approvers in your business.

Payable can keep all your banking data centralised without losing sight of your payments

Migrating Data

With Payable you will be able to connect your global banking accounts in one central dashboard and store up to the last three years of your SVB UK transaction data, even after the account is deactivated.

Our intelligent reconciliation engine will match your payments either sent to your SVB UK or HSBC Innovation Banking accounts and automatically reconcile against your invoice data saving your team valuable time and reducing disruption to your business during migration. Payable also connects directly with your ERP or accounting systems, giving you full visibility of your invoice data, payment flows and account balances in real-time.

Building HSBC Connect Integrations

Our team is highly experienced at building and maintaining connections across all major banking providers in record speed. We can get your SFTP connection live in a matter of weeks with zero engineering effort required from your side. We undertake all testing and training so your team will be handed over a fully operational connection with BAU restored.

Payment Approvals

For new HSBC Connect users, our approval controls and user access settings ensure that payments are immutably sent with the right approval and to trusted beneficiaries mitigating the risk of fraud and error that can arise from disjointed payment processes.

Announcements

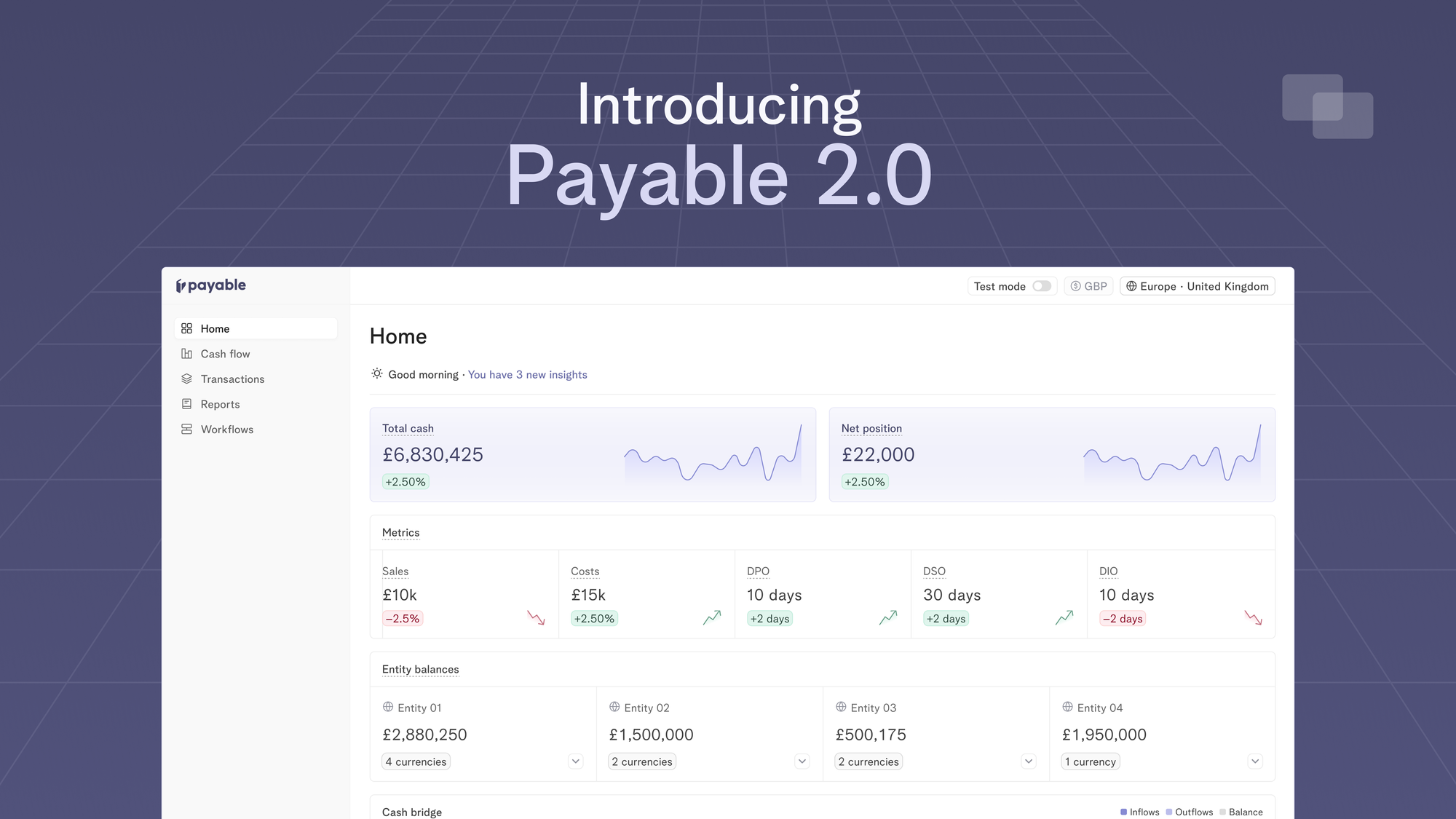

Introducing Payable 2.0 - one platform to optimise working capital, make fast liquidity decisions and move your cash metrics in real-time

13 Apr 2024

Today, we’re excited to launch Payable 2.0 which is our evolution to a more connected, intelligent and automated platform for finance teams to track their cash flows in real-time.

Cash Management

Mastering 13-week direct cash flow forecasts

26 Mar 2024

Knowing how your cash flow will behave in the future is crucial for the success and sustainability of any company. One way to achieve this is through the use of a 13-week direct cash flow forecast, which provides a detailed projection of a company's inflows and outflows over a specific time period.