Tracking your cash position and knowing how much money is in your bank at any point in time is a core responsibility of any Finance team. If you've ever experienced the panic of opening an operating cash flow or bank account and realising you might miss your payroll, then chances are, you understand the importance of accurate and timely cash reporting.

When it comes to such an important task, you may relate to the frustrations of how tricky it can be at times. Between multiple bank accounts in a host of fluctuating currencies, deposits, withdrawals, transfers and expenses, keeping track of your cash position can quickly turn into a time-consuming, often tedious and manual exercise.

What is a daily cash position report?

A daily cash position report provides an overview of your company's cash balance at the end of each day and how it was affected by inflows and outflows. Not every business needs a daily cash position report. Your cash reporting may follow a weekly or monthly cadence depending on your scale and transaction volume. Keeping a watchful eye on your cash position, however, should still be part of your regular routine to ensure your cash flow is behaving itself.

What is included in the daily cash position report?

A typical daily cash position report will include your cash balances across all bank accounts and an overview of your cash movements since the previous day. A regular visit to this kind of view allows you to get to know the cash cycle and will keep you well informed of positive or negative trends when it comes to problematic paying customers, surprise bills or cost-saving opportunities.

What are the blockers when preparing daily cash position report?

As your business grows in size and complexity, the likelihood is you will need to employ multiple bank accounts and possibly some counterparty diversification to protect and preserve your cash. Multiple accounts across multiple banks will inevitably make cash visibility and reporting tricky. Here are some of the main barriers we find from talking to our customers:

Time is money, money is time

Statements or transaction exports must be downloaded for all accounts every day. For some more modern banking providers like Revolut, N26, Mercury or Wise, this is usually quite a pleasant experience. Still, if you have funds in a lot of more traditional banks (not naming any names!) this can be a lot less fluid and take considerable effort.

Format #ERROR

You have all your bank account data in a folder full of CSVs but of course, these banks don’t all conform to one standard - that would be too easy! Importing, sanitising and standardising your data requires more manual effort, ensuring you have some controls in place along the way to protect against any omissions. This is before you go and translate everything to a presentation or functional currency which is a whole other process. Let’s hope “Master Cash Report_v216” doesn’t act up again and cause PTSD (Post Traumatic Spreadsheet Disorder).

Thinking ahead

Reporting should be (and can be) about unlocking insights that help minimise risk and optimise your liquidity as you plan for growth. When creating a process for cash reporting, think about a scalable and automated solution that can support multiple accounts and currencies.

Take the uncertainty and risk out of your reporting and focus on what really matters

We understand how cumbersome and time-consuming cash reporting processes can be. We get it. That's why we built Payable, a cash intelligence platform designed to automate your cash reporting, run dynamic forecasts and scenarios and help you manage your liquidity in real-time using a single dashboard.

By leveraging our experience in open banking and direct bank integrations, our cash flow categorisation tool gives you a standardised way to view, manage and forecast the beating heart of your business. Get a real-time view of your cash flow. Visibility has never been clearer.

Financial Automation

07 Aug 2024

Prior to launching Payable, I built platform and marketplace payments at Checkout.com. Picture this a seller in one country, a buyer in another, and a marketplace connecting them—taking a cut. This experience opened my eyes to fintech infrastructure. The Fintech Trifecta: Cheaper, Faster, Simpler Fintech revolves around moving money efficiently. Venture capital investment theses in fintech universally revolve around three core principles: cheaper, faster, and simpler solutions. Whether it's c

Announcements

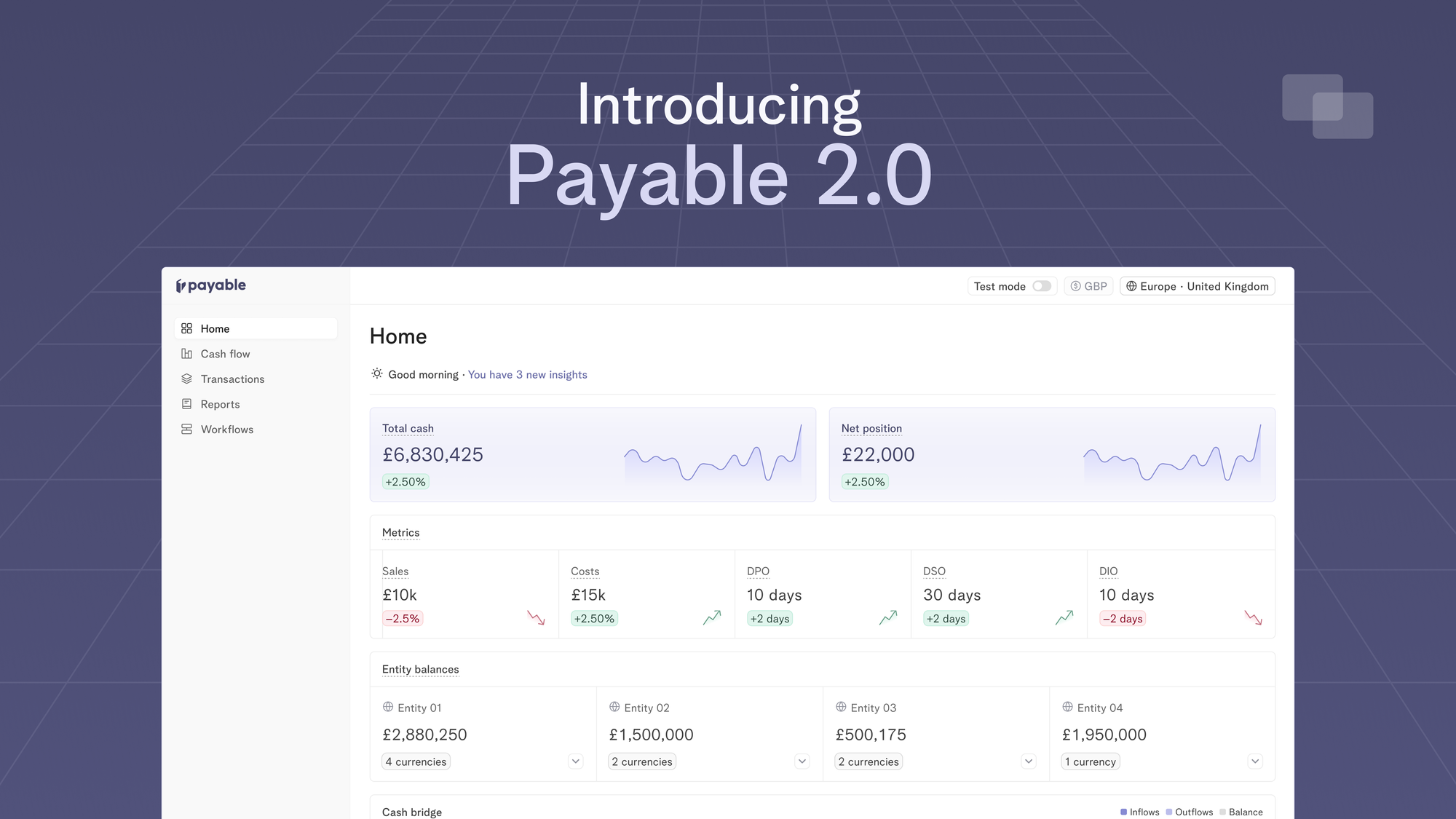

Introducing Payable 2.0 - one platform to optimise working capital, make fast liquidity decisions and move your cash metrics in real-time

13 Apr 2024

Today, we’re excited to launch Payable 2.0 which is our evolution to a more connected, intelligent and automated platform for finance teams to track their cash flows in real-time.