As businesses scale, it becomes more difficult for teams to communicate and collaborate effectively. They use separate systems, processes and software that creates data silos across the business. And that is why businesses processing a high volume of data invest in ERP software, to provide a single source of financial truth.

However, it is often the nemesis for your team in finance as ERP software is built for handling a high volume of data, but not for automating financial operations. The lack of interoperability between ERP and bank connections makes it difficult to access transaction data, creating manual work for your team when reconciling payments and closing month-end.

Let's take a look at the issues when reconciling bank transactions using ERP systems.

Lack of automated bank connectivity

When your business grows, so does your banking structure and payments stack. Your team finds itself managing multiple bank accounts and payment providers across different regions, spending countless hours each month on reconciliation and keeping your P&L in check.

All your payment details and bank feeds will need to find their way into your ERP system to perform financial reporting and reconciliation. The out-of-the-box connections available generally have restricted reference and payer details, meaning identifying and reconciling transactions is an arduous task.

For connections without automated access to transaction data, your process probably looks something like this:

Step 1: Retrieving bank feeds

- Manually logging into all of your banking and payment portals, and retrieving bank feeds. Depending on the size of the business that varies from a handful of accounts in one country up to tens of accounts across many regions.

Step 2: Formatting the data

- Working the data so it fits the format your ERP supports. To ensure the data can be used in your ERP system, it has to be formatted according to its requirements.

Step 3: Performing bank reconciliation

- Matching ERP transactions with your bank statements line by line and investigating and resolving any discrepancies.

Since ERP tools are not specialised in building and maintaining bank connectivity you can work with your engineering team and build connections to your banks. That will require significant engineering effort as there is no single standard for bank connectivity. Each channel (Host-to-host, Open banking, SWIFT) requires its own integration, data mapping and expertise to maintain over time in line with regulatory frameworks. All that requires precious engineering time that would be taken away from your core business.

Reconciliation logic only supports basic use cases

Now that you have the data in your ERP system it’s time to work on reconciling transactions to help you close your books and keep accounting in check. Bank reconciliation is the process of matching records from your bank statement with bank transactions you already have in your general ledger. It’s taking one payment from a bank statement and matching it with your invoice, bill or Chart of Accounts records.

Sounds simple, right? Not quite.

Given how differently the two data sets are sourced - one from the bank statements and the other from customer and invoice records in your general ledger - the data will have different formats and references. ERP tools do not optimise transaction data for reconciliation, meaning your chances for an automated successful match are low.

ERP systems use simple logic to match these data sets typically using names, dates, amounts or references to find the match. Oftentimes one of these fields won’t generate a confident match on its own or there might be a match with one variable, but not the other. You might even have a scenario where you have a match but the amount will differ, resulting in a lot of manual intervention, battling with an un-intuitive interface.

The reality is that business payments are complex and so are the use cases. The simple reconciliation logic that ERP systems have, does not serve the needs of scaling finance teams. It is missing advanced logic and features to enable your team to handle a large volume of payments, recognise invoices that are under or overpaid and use AI algorithms to learn from previous matches.

Reconciliation is manual even with successful matches

When ERP systems perform reconciliation and successful matches are generated, those matches typically will have to be approved manually to complete the reconciliation. Any mismatch will also require manual intervention to investigate one by one.

Entering journal entries and bill payments in ERPs is error and risk-prone, as it’s easy to create transaction records that aren’t tied back to a real payment in your bank account.

While that might work for smaller-scale businesses with a low volume of payments, when you handle tens of thousands of payments a month, the manual approach is simply not sustainable. You can’t afford to spend time approving each matched payment or tracking down lost payments or invoice records.

We can help

At Payable, we recognise the complexities of financial operations and reconciliation, especially for scaling businesses. You don’t want to be matching payments line by line when the wider business is launching new products and expanding to new regions. Payable automates your entire reconciliation process. Your ERP is maintained as your single source of truth for your business, while also enhancing your financial processes, it’s a win-win!

We seamlessly integrate your bank transactions into your ERP system saving you time (and money!) tracking lost payments and invoices. Our reconciliation engine fully automates your reconciliation process from start to end. With a +95% match rate and ML-powered learning algorithms, your team will only spend time on matches that truly need your attention while everything else is automatically reconciled and allocated to the right Chart of Accounts.

Automate reconciliation, reduce errors and spend time on work that matters.

Announcements

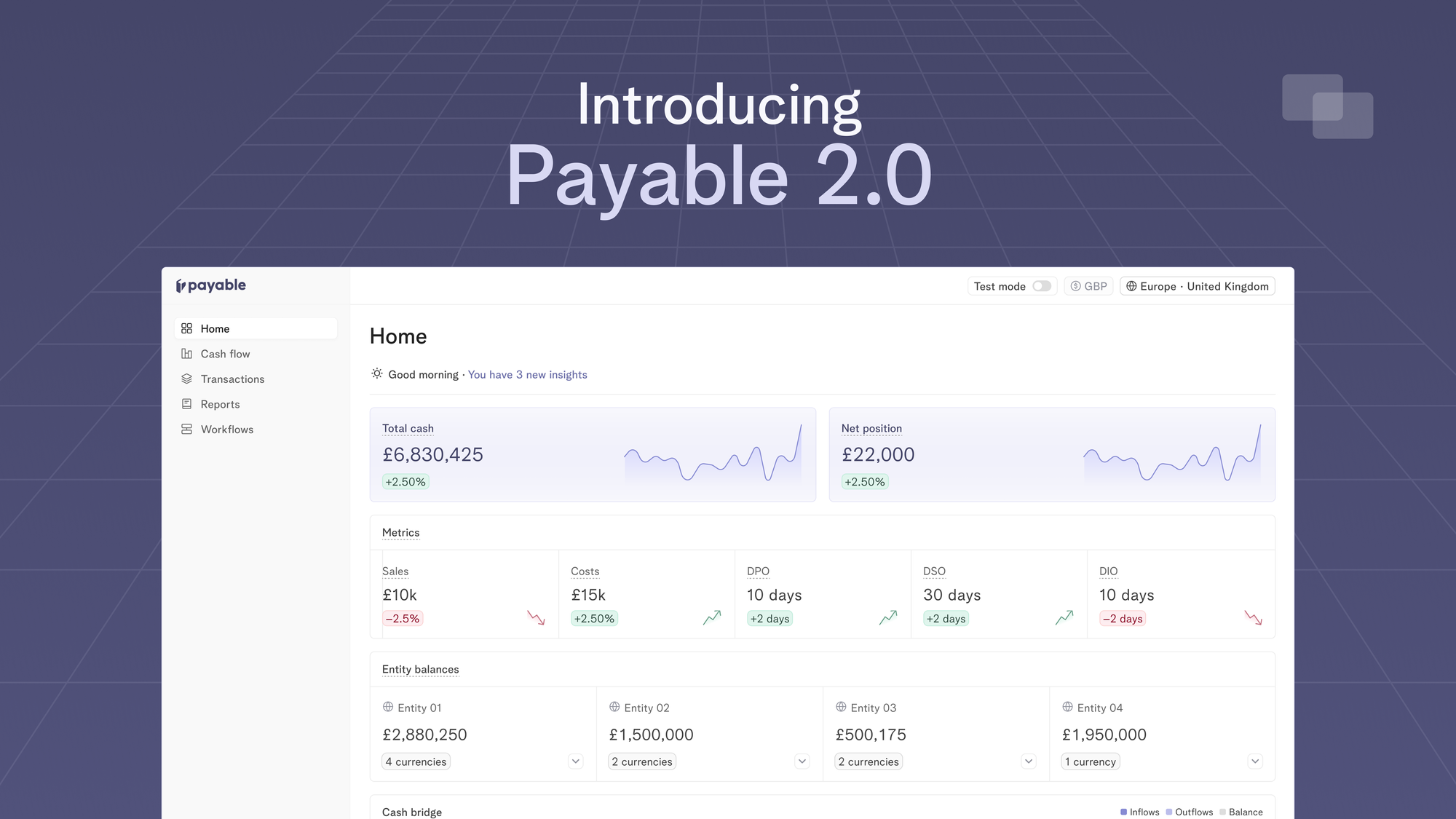

Introducing Payable 2.0 - one platform to optimise working capital, make fast liquidity decisions and move your cash metrics in real-time

13 Apr 2024

Today, we’re excited to launch Payable 2.0 which is our evolution to a more connected, intelligent and automated platform for finance teams to track their cash flows in real-time.

Cash Management

Mastering 13-week direct cash flow forecasts

26 Mar 2024

Knowing how your cash flow will behave in the future is crucial for the success and sustainability of any company. One way to achieve this is through the use of a 13-week direct cash flow forecast, which provides a detailed projection of a company's inflows and outflows over a specific time period.