Xero is one of the leading online accounting tools available. Small businesses all over the world rely on Xero to track their income and expenses, create invoices, pay bills, and manage their inventory. While it’s perfect for small business accounting, Xero has its limitations for finance teams reconciling high volumes of transactions across multiple business entities. Relying on Xero to automate month-end close will be a challenge, but not all is lost, as there are other options that make Xero work harder for finance teams.

What is bank reconciliation in Xero?

In Xero, bank reconciliation is the process of matching the transactions recorded in your Xero accounting software with the existing transaction in your bank account. The purpose of bank reconciliation is to ensure that your financial records accurately reflect the transactions that have taken place in your bank account.

How to do bank reconciliation in Xero?

Here are details on how the bank reconciliation process works in the reconcile tab on Xero:

- Importing bank transactions: Where connections are available, Xero pulls all the transactions directly in the platform using bank feeds. Once connected, the bank transactions are automatically imported into Xero. If this isn’t possible, files of transactions can be uploaded against an account.

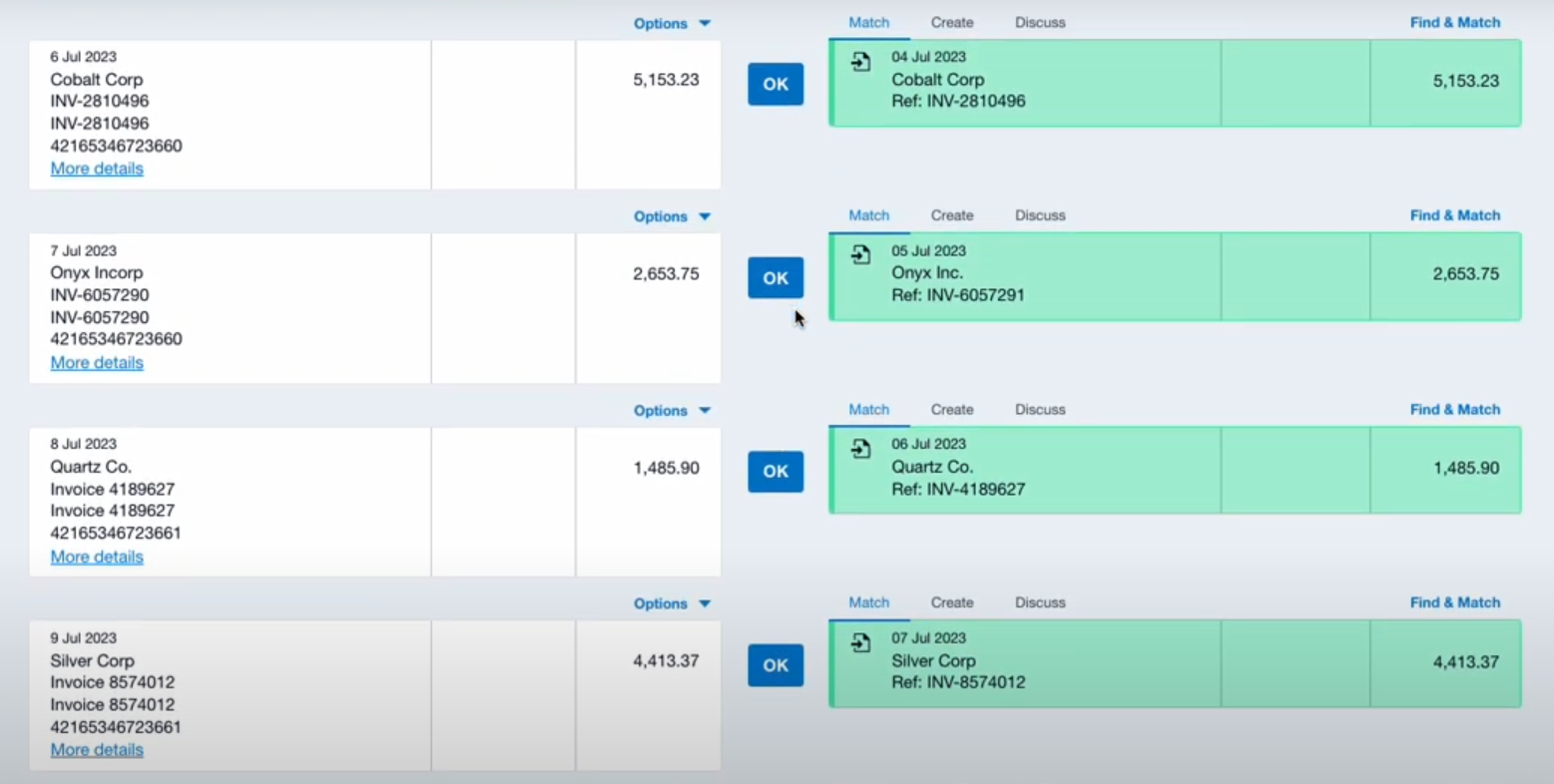

- Matching transactions: After the transactions are imported, the Xero system tries to match the transactions with any corresponding records in Xero. These could be invoices, expenses, payments, or any other financial activities that have been entered into the platform.

- Reconciling: Once the transactions are matched the reconciliation process starts. Xero will show a list of the transactions that have been successfully matched and need to be approved, alongside any unmatched transactions that need to be manually reconciled.

- Resolving discrepancies: If there are any discrepancies between the bank statement and Xero records, they need to be investigated and corrected. Common reasons for discrepancies include incorrect values, references, or missing records.

- Finalising reconciliation: Once all discrepancies have been resolved, and the transactions match between Xero and bank files the reconciliation can be finalised. Xero will then mark the bank account as reconciled, and the ending balance in Xero should match the ending balance in the bank statement.

How Xero reconciliation logic works?

Xero will suggest matches based on the amount, the date and the name of the payee. If there is only one transaction in Xero that matches the amount and date on the bank statement, Xero will automatically suggest that match. If there are multiple transactions that match the amount and date, Xero will give a list of possible matches to select the correct one.

For example, if you have a bank statement line for a £100 payment to "Happy Corporation Ltd" on January 1st, Xero will suggest a match for any transaction that has the same amount, date, and payee. If there is only one transaction that matches, Xero will suggest that match. If there are multiple transactions that match, Xero will give a list of possible matches to choose from.

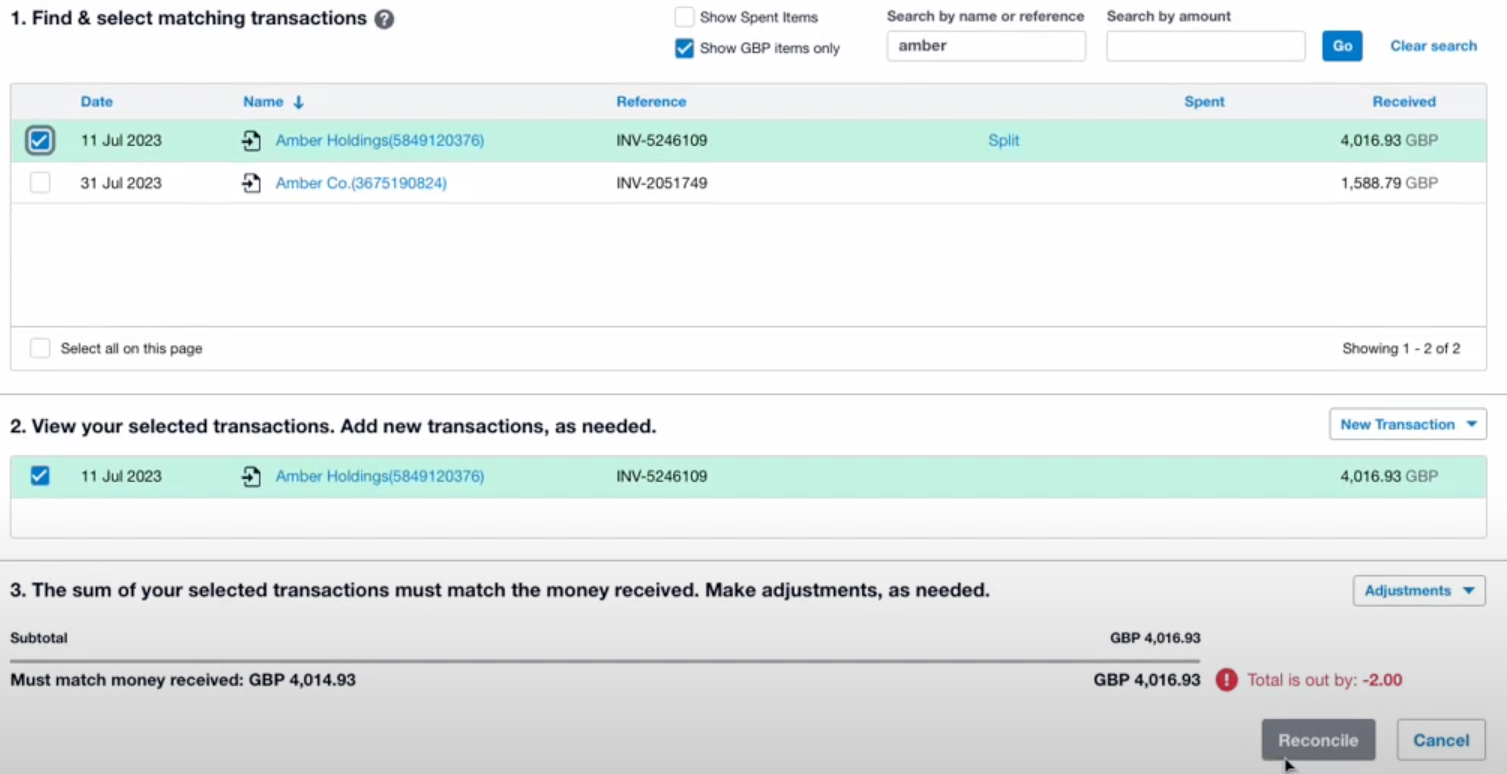

Xero allows to manually suggest a match for a transaction based on the payment details. In the bank reconciliation screen click on the "Find and Match" button, enter the details and click on the "Search" button. Xero will then show a list of possible matches.

It is important to note that Xero's suggested matches are not always accurate. It is always a good idea to review the suggested matches carefully and to make sure that they are correct.

Challenges with Xero bank reconciliation

Not built for scale

Xero is designed for bank transaction volumes of up to around 2,000 per month and simple corporate structures with 10-15 bank accounts. It struggles to reconcile over a thousand invoices a month and manage large payment volumes from multiple accounts and business entities.

Matching is done on exact values

Xero reconciliation logic is done on exact value matches. That means Xero can only reconcile transactions that match the information in the bank statement with the existing transactions in Xero such as invoices, bills or expense claims.

Manual process

Xero integrates with leading payment service providers (PSP) to accept payments for invoices issued with Xero. Once payment is made, Xero would record it in the transactions list but reconciliation would still be slow and require manually checking bank account to ensure funds are there before completing reconciliation.

Each transaction must be approved

Even when the payment has been matched between bank statements and existing transactions in Xero dashboard, someone in the finance team has to manually accept each match for it to be considered ‘reconciled’.

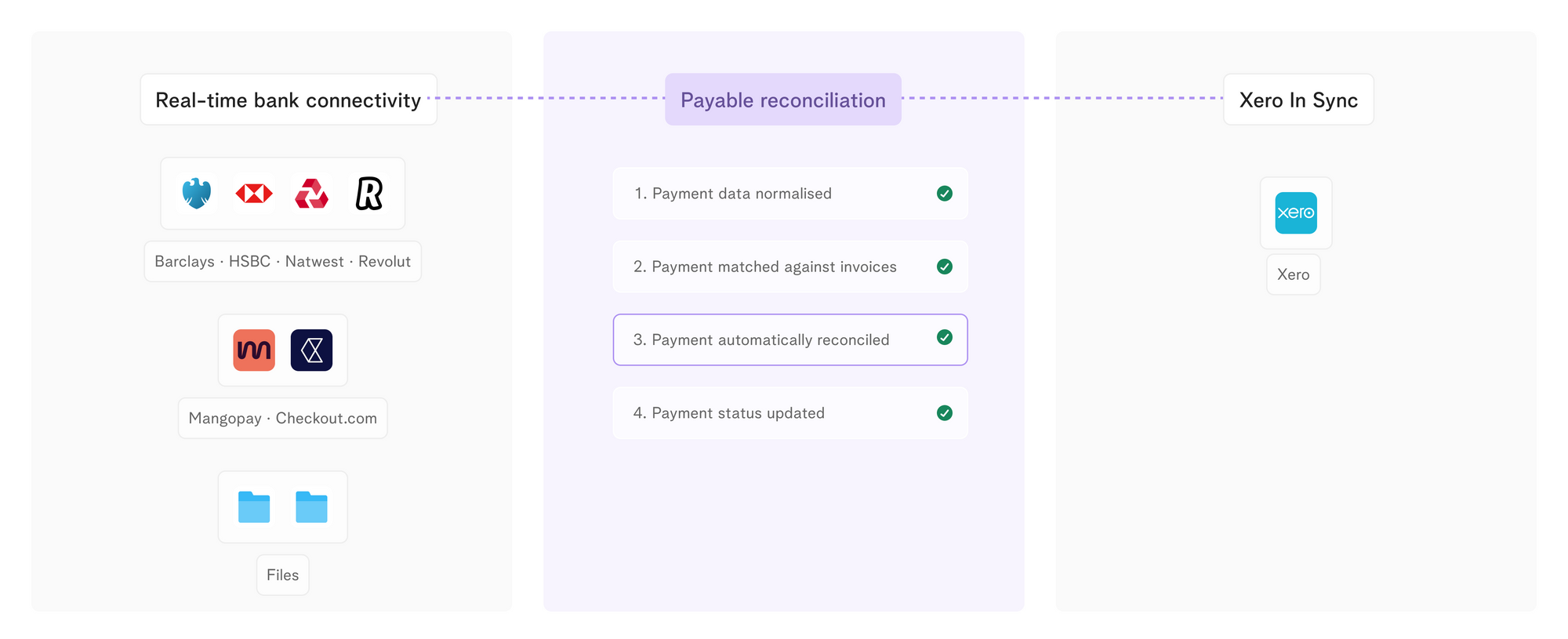

Payable automates Xero reconciliation from start to end

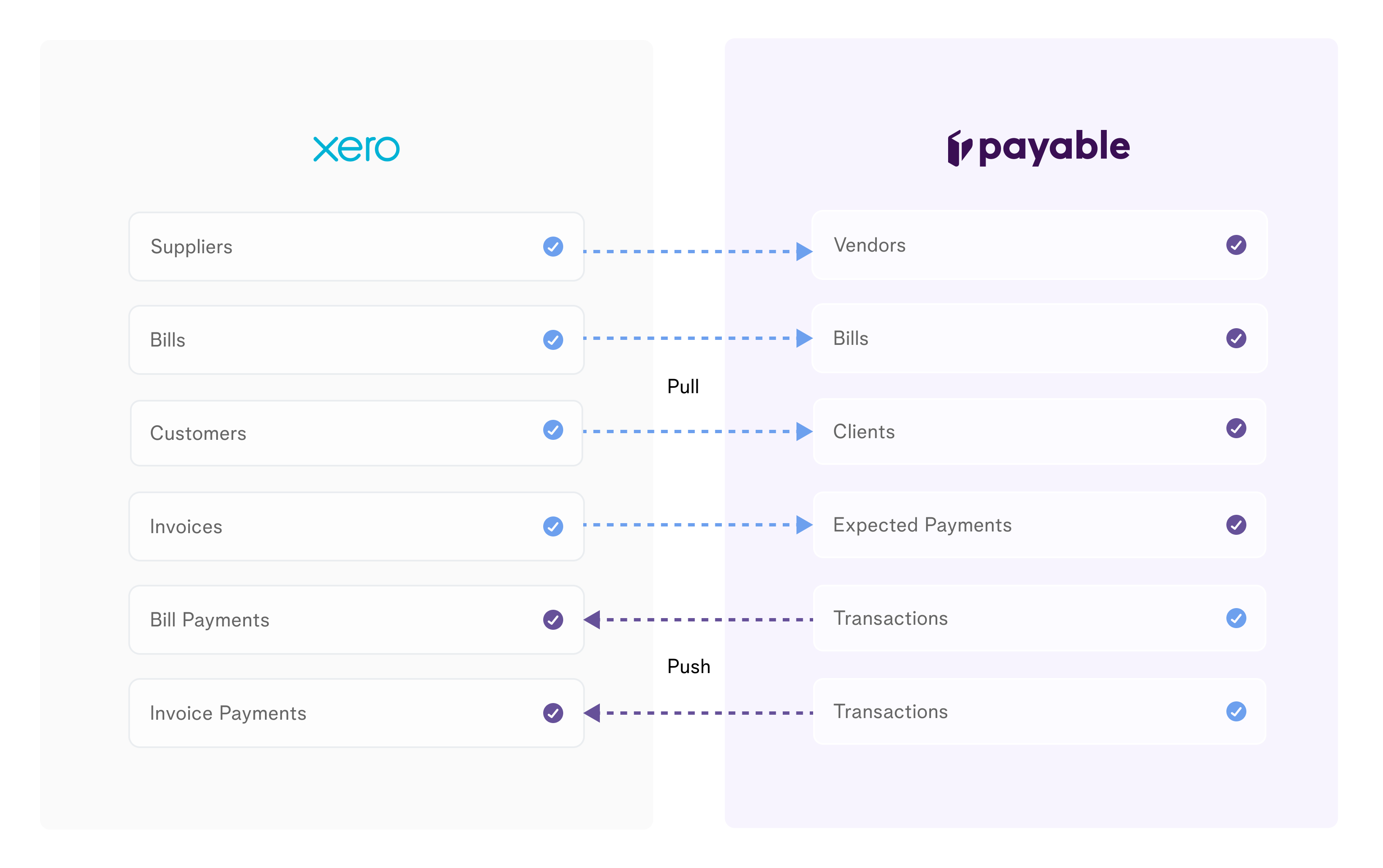

Payable saves finance teams hours each day by automatically reconciling payments directly between Xero and their banking portals. Our direct connection with banks, payment providers and Xero means that all your invoices, bills and expenses are automatically reconciled with correct bank transactions in real time.

Payable direct integration ensures that any updates made in Xero are reflected in real time. As soon as an invoice or bill is paid, our two-way sync ensures that both systems are in sync, so you don't have to manually update Xero.

How Payable reconciliation logic works?

Payable match rate is +95% and its reconciliation engine is based on minimising the rate of false matches, whilst giving the most intelligent reconciliation option possible to automate the process from start to end:

- Clean up transaction details: Payable will automatically clean the payment details to ensure providers name and reference information is extracted as clearly as possible.

- Data matching: we will match the transaction data to the bill, invoice or expense details from Xero giving a complete visibility of what has been paid and what is left outstanding.

- Automated Reconciliation: When an exact match or a strong match is found, we will automatically reconcile the payment. If there are a number of options to match, then we will consider which value is most closely aligned based on confidence levels, and past matches.

If a transaction cannot be reconciled, due to a lack of strong options or too many potential matches, Payable will provide suggested matches, with an indication of how strong that match will be. The user interface makes it super easy to see which is likely to be the strongest match. Each time suggested account is accepted, Payable algorithm learns and automates future matches.

Why use Payable to automate Xero reconciliation

Using Payable to get more from Xero has many benefits:

- Time savings: Payable's direct connection with Xero and banking partners saves hours of manual data collection.

- Faster book closing: Automated reconciliation accelerates the closing of books, linking Xero bills and invoices with bank transactions seamlessly.

- Eliminate errors: reduce the risk of human error by automating data collection.

- Real-time updates: Payable keeps Xero up-to-date with real-time updates when payments are automatically reconciled.

- Enhanced cash visibility: a single source of truth for all cash movements and control.

How to use Payable to automate Xero bank reconciliation

Existing customers can link their Xero account via our direct integrations from Payable, simply:

- Log into Payable

- Navigate to Sources tab, click +Add source and select Xero

- Head to the Reconciliation tab to have a complete view of what's paid and what's outstanding.

Automating Xero bank reconciliation with Payable not only streamlines the process but also empowers finance teams to handle high transaction volumes effortlessly. Get in touch today to explore how we can save you hours when reconciling payments with Xero.

Announcements

Introducing Payable 2.0 - one platform to optimise working capital, make fast liquidity decisions and move your cash metrics in real-time

13 Apr 2024

Today, we’re excited to launch Payable 2.0 which is our evolution to a more connected, intelligent and automated platform for finance teams to track their cash flows in real-time.

Cash Management

Mastering 13-week direct cash flow forecasts

26 Mar 2024

Knowing how your cash flow will behave in the future is crucial for the success and sustainability of any company. One way to achieve this is through the use of a 13-week direct cash flow forecast, which provides a detailed projection of a company's inflows and outflows over a specific time period.