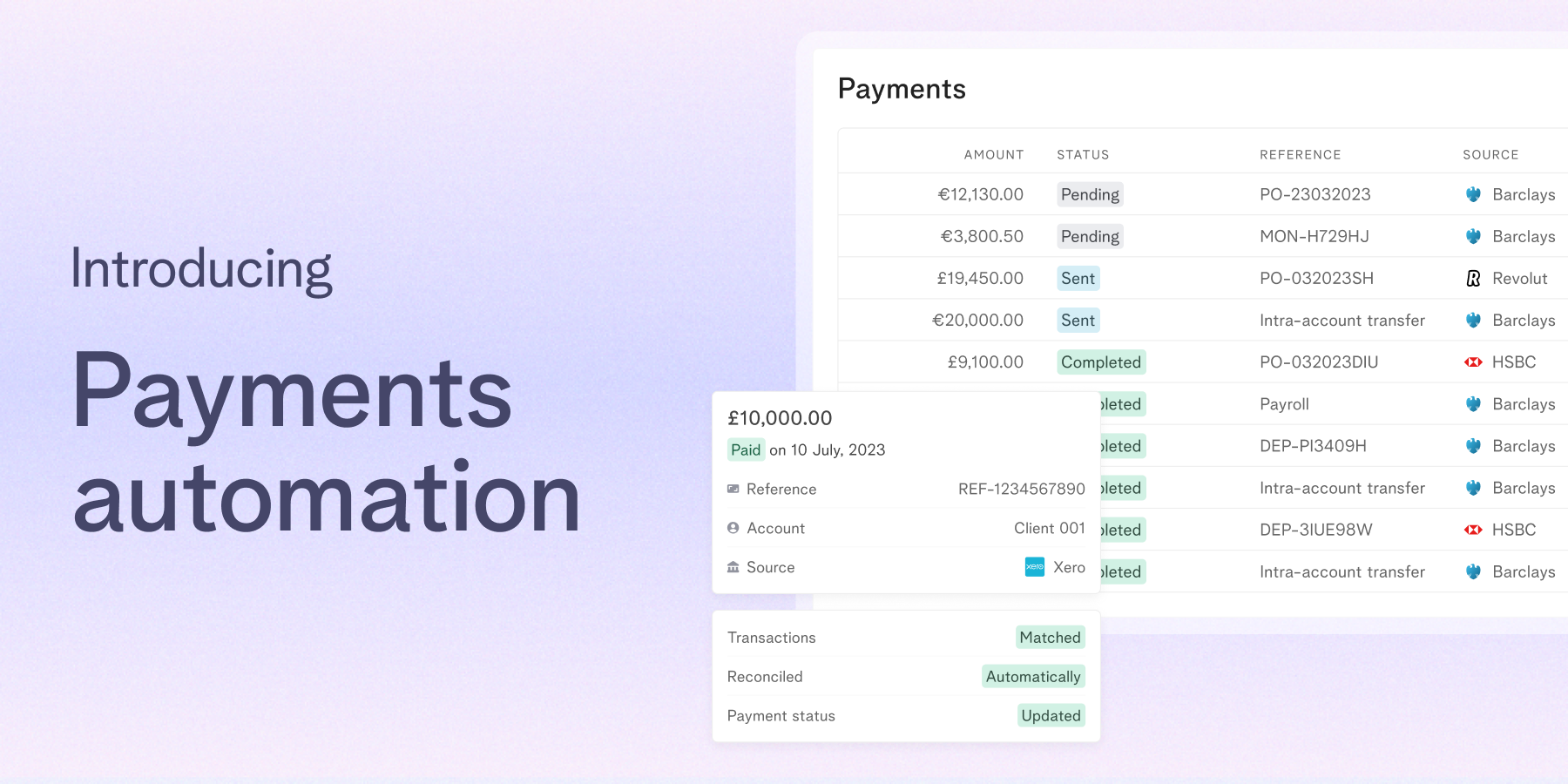

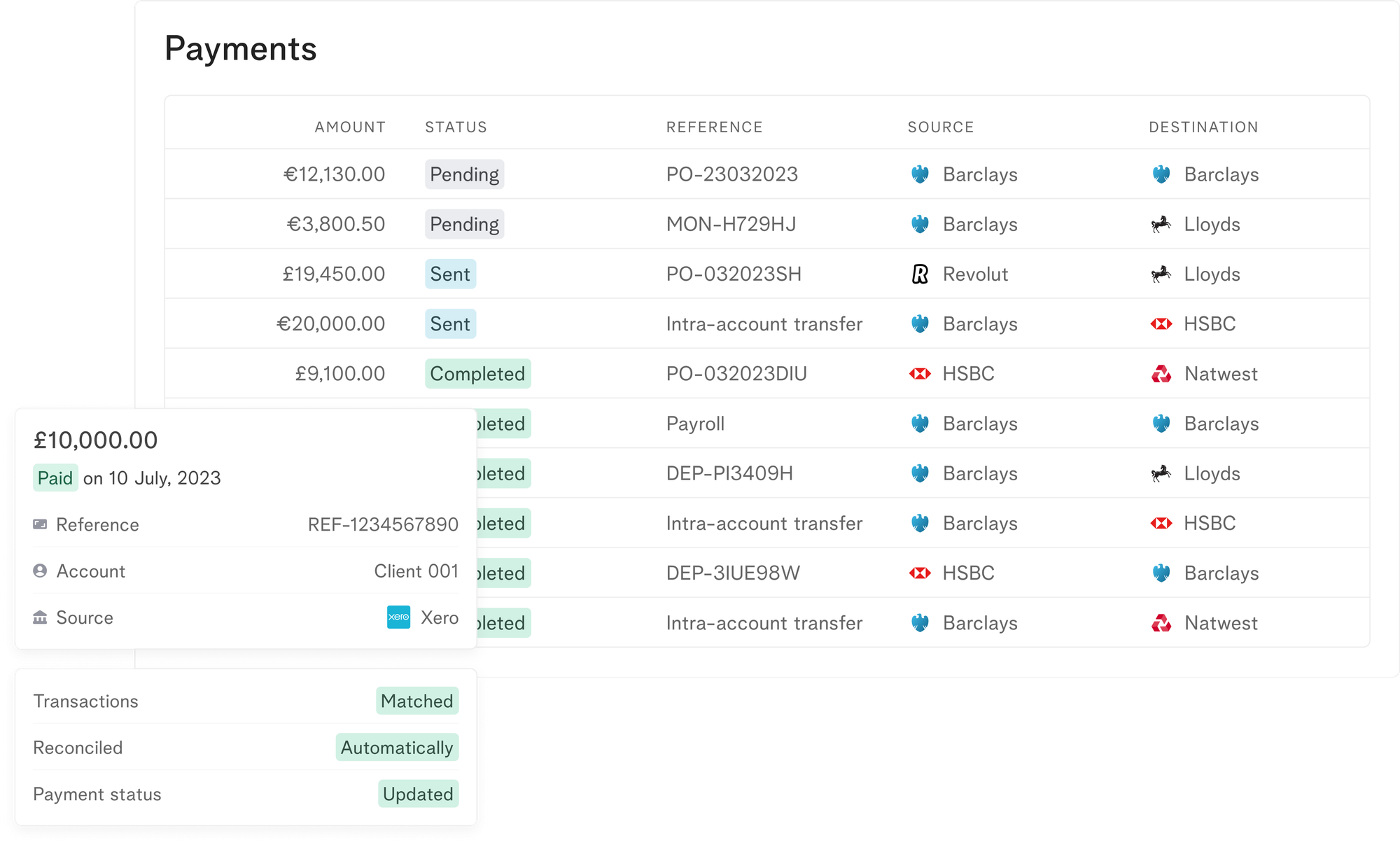

Our Payments automation module automates your payment instructions directly from Payable. Imagine eliminating all those manual processes and seamlessly initiating and tracking your payments, all from one convenient dashboard. We connect with your bank and ERPs so you can easily automate vendor payments without building and maintaining complex integrations.

Stay compliant while operating at pace

But it doesn't stop there. We know that operating at scale has its challenges but risk should not be one of them. With our payments automation module you can easily set up user roles for compliant approvals. Say goodbye to unnecessary risks and hello to intelligent workflows. We keep a comprehensive audit trail giving you a peace of mind while streamlining your payment processes with ease.

End-to-end payments visibility

Worried about visibility? Don't be. We believe in transparency and so does our product. Our module offers complete transparency, allowing you to gain full insight from the moment the invoice is created in your ERP to the point the payment has landed and reconciled. Approve payments quickly, automate reconciliation, and easily generate reports on your outgoing funds.

Payment controls from a single dashboard

Gain complete visibility into the entire payment process, allowing you to monitor each payment's journey from initiation to completion. Whether you need to execute single transactions or handle batches of payments, it's as simple as a click of a button. The best part is that your accounting and ERP tools will seamlessly synchronise payment updates with your vendors and bills, making your financial operations smoother and more efficient.

Here's how simple it is:

- Create a payee: Store all payee details once and forget the hassle of repeated entries.

- Initiate payment: Whether it's a one-time transaction or recurring, send payments swiftly.

- Four-eyes approval: Every payment undergoes dual approval, enhancing compliance controls. Need to make changes? Cancel and revert in a jiffy.

So why wait? Take your finance team to the next level with Payments automation. Say goodbye to manual processes and hello to a more efficient and streamlined payment experience. Scale your operations and watch your team thrive.

Announcements

Introducing Payable 2.0 - one platform to optimise working capital, make fast liquidity decisions and move your cash metrics in real-time

13 Apr 2024

Today, we’re excited to launch Payable 2.0 which is our evolution to a more connected, intelligent and automated platform for finance teams to track their cash flows in real-time.

Cash Management

Mastering 13-week direct cash flow forecasts

26 Mar 2024

Knowing how your cash flow will behave in the future is crucial for the success and sustainability of any company. One way to achieve this is through the use of a 13-week direct cash flow forecast, which provides a detailed projection of a company's inflows and outflows over a specific time period.