The reconciliation process is one of the core functions of a finance team. It’s for good reason - effective reconciliation is essential for ensuring the accuracy of financial statements, uncovering errors, preventing fraud and meeting regulatory requirements.

Join us as we mark our first Journal Entry - a series of articles about mastering reconciliation. In this first article, we will explore the fundamentals of reconciliation before diving in to reconciliation best practices and practical tips to help your company master the intricacies of reconciliation.

What is bank reconciliation?

The term bank reconciliation is the process of comparing and verifying bank records with a company’s record of transactions (also called a journal entry). Some refer to this as the financial close process.

If we look at the bank reconciliation process in detail, we’ll see it involves four key steps:

- Company records: Using your general ledger (GL), compile a list of all payments and deposits via your accounting software for a specific duration.

- Banking records: Gather the corresponding bank statements for that period, reviewing all activities affecting your company’s bank account i.e. bank deposits and withdrawals.

- Compare and verify: Compare your company’s and the bank’s records of financial activities, verifying revenue on your books and company expenditure.

- Close out: Unravel any discrepancies and finalise your company’s cash flow statement.

Why is bank reconciliation important?

The bank reconciliation process is a crucial and legally required part of a company’s financial operations. Accurate and timely reconciliation processes deliver many business benefits, so let’s take a look at the key reasons why bank reconciliation is so important.

Identifying accounting errors

Accurate financial records are the cornerstone of effective and efficient financial operations. Regular and thorough bank reconciliation helps finance teams identify errors, whether this be a credit note not processed, missing transaction or unsettled payment due to a timing difference. If left uncovered, errors can have a serious impact on a company’s finances.

Fraud prevention

Over £1.2 billion was stolen through fraud in 2022 according to Finextra’s Annual Fraud Report 2023. Aside from the financial losses, fraud can cause serious damage to a company’s reputation, erode consumer trust, and in serious instances cause total financial ruin. Bank reconciliation helps companies detect and prevent fraud, theft and loss by flagging up and stopping unexpected payments. Spotting fraudulent activity earlier helps companies to mitigate risk.

Regulatory compliance

Reconciling transactions allows companies to accurately submit regulatory reports and returns. Compliance with the growing swathes of financial regulation is only becoming more challenging, so it’s never been more important to maintain accurate accounting records to stay on the right side of regulatory compliance.

Accurate forecasting

Sound financial decisions can only be based on timely and accurate data. Having a clear financial picture of a company’s cash flow gives finance teams the confidence to provide accurate forecasting, which is essential when it comes to assessing the implications of financial decisions and attracting investors.

Types of reconciliation

There are several types of reconciliation that finance teams need to carry out. Let’s take a look at the most common types of reconciliation.

Bank reconciliation

This is the process of reconciling two sets of records; your company’s and your bank’s. Ensuring the accuracy of your company’s financial records helps companies identify accounting errors, prevent fraud, meet compliance standards, and make informed business decisions based on accurate forecasts. Using the double-entry accounting system, finance teams offset a debit with a credit, recording every transaction in at least two accounts.

Intercompany reconciliation

A company group can be made up of multiple subsidiaries or divisions with a holding company at the helm. Intercompany reconciliation is the process of verifying and reconciling financial transactions between all of these entities. Given the potential for huge volumes of transactions, investing in automated reconciliation is especially viable for companies with complex structure.

Balance sheet reconciliation

This is the process of reconciling a business’ balance sheet with bank statements and GL entries to verify the accuracy of financial statements. This enables finance teams to compare recorded figures and actual values to identify errors and resolve discrepancies. Given the attention that auditors pay to financial statements, balance sheet reconciliation is a vital process to ensure accuracy and completeness.

Cash reconciliation

Cash reconciliation specifically focuses on a company’s cash balance, by verifying cash on hand with what’s in the cash book. Having full transparency when it comes to company cash flow empowers businesses to make more informed decisions about the future. However, manually entering data for your cash reconciliation is more likely to lead to errors, which is why automation, which is less prone to errors, is so valuable. IAS 7 prescribes how to present information in cash flow statements, standardising this activity in the UK.

Best practices for reconciliation

Take a look at these practical tips to help finance controllers optimise their reconciliation processes.

Establish robust internal controls

Optimising your financial management processes by establishing and maintaining robust internal controls brings a multitude of business benefits. When it comes to reconciliation, following these tips can help you turn your reconciliation process into a well-oiled machine.

- Define reconciliation procedural steps

- Attach timelines and deadlines

- Document and communicate these measures with the relevant finance team members

Consistency in reconciliation helps to prevent costly mistakes and protect against fraud.

Implement segregation of duties

Procedures and protocols are all well and good as long as they’re followed by the right people at the right time. Assign specific members of your team to take responsibility for different aspects of the reconciliation process, including recording, reconciling and approving financial transactions. This is called segregation of duties.

Not only does taking this approach ensure everyone knows what they should be doing when, it also helps reduce errors and fraud by enhancing accountability. The more eyes you have on your financial data at defined intervals, the more likely you are to uncover discrepancies faster.

Leverage automation tools and technology

Automated reconciliation tools and technology allow finance teams to quickly and accurately align financial records and assign automated workflows to exceptions. They can be run weekly, monthly or as regularly as needed.

Not only is performing reconciliation processes manually is painfully time-consuming, it’s also prone to errors (who hasn’t seen an Excel file riddled with errors?). Automating your reconciliation process saves hours if not days in time, allowing your finance team to focus on more strategically important tasks.

When choosing from the multitude of automated reconciliation tools available, consider the following:

- Compatibility with your ERP or accounting software

- How many licences you need

- Volume of statements you plan to match

- Capabilities such as bulk upload of statements and reporting

- Ease of use

- Availability of customer support

Maintain clear documentation

Establishing standardised reconciliation processes and procedures helps keep your financial operations ordered. But it doesn’t have to be complex. Here are some simple ways to help you maintain clear documentation when it comes to your reconciliation processes:

- Retain and correctly store important documentation like bank statements, invoices and receipts.

- Document the procedures and processes your company follows in relation to the reconciliation process (this is important for audit trails and compliance).

- Maintain accurate supplier records

Review regularly

A ‘lock-and-leave’ approach won’t cut it when it comes to the reconciliation process. Regularly reviewing everything from your tools, procedures and document storage to your reconciled records is vital.

Significant discrepancies should be investigated regularly to uncover the underlying issues, since these can cause bottlenecks in reconciliation processes as well as the potential for fraudulent activity.

Regular reviews also facilitate continuous improvement which is an important tool against the ever-increasing sophistication of scams and for enhancing your company’s potential.

Summary

Reconciliation can be a headache for finance teams, given the huge volumes of data and hours needed to complete the process. According to a PWC report, 30% of your finance team’s time is spent on manual reconciliation.

But reconciliation isn’t optional. Reconciliation outputs strategically-vital data that business leaders rely on to prevent fraud, remain legally compliant and drive their business forward.

For scaling organisations, reconciliation becomes more complex and therefore more time-consuming. If done manually, reconciliation can prevent finance teams working on more important operations. However, increasing numbers of scaling businesses are switching to automated reconciliation to streamline the process and overcome this challenge.

Announcements

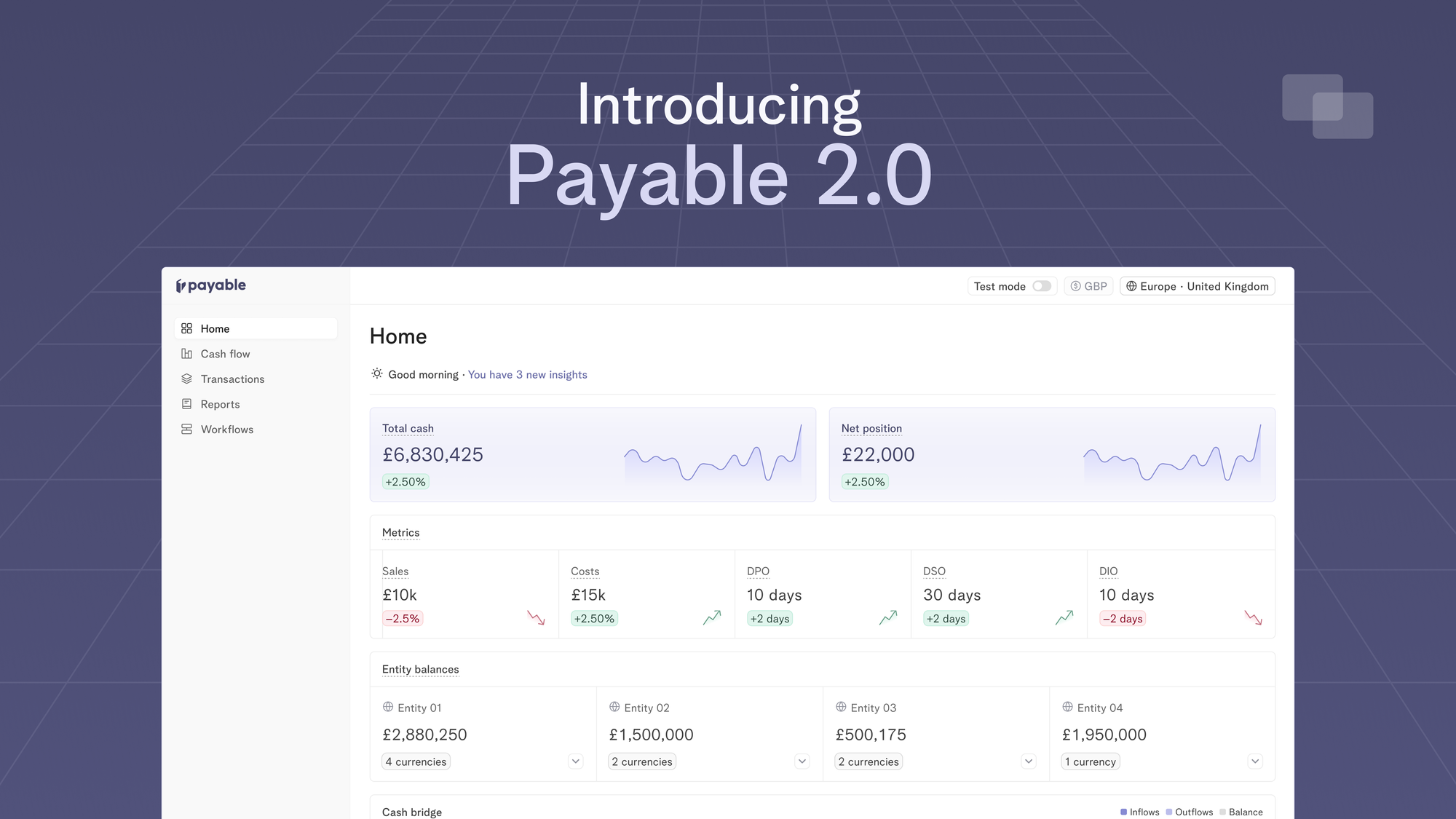

Introducing Payable 2.0 - one platform to optimise working capital, make fast liquidity decisions and move your cash metrics in real-time

13 Apr 2024

Today, we’re excited to launch Payable 2.0 which is our evolution to a more connected, intelligent and automated platform for finance teams to track their cash flows in real-time.

Cash Management

Mastering 13-week direct cash flow forecasts

26 Mar 2024

Knowing how your cash flow will behave in the future is crucial for the success and sustainability of any company. One way to achieve this is through the use of a 13-week direct cash flow forecast, which provides a detailed projection of a company's inflows and outflows over a specific time period.