Hi, I’m Boris, I was doing my final year of high school this summer when I joined Payable as a Software Engineering Intern building an ROI calculator. Here are my reflections of my time at Payable and what I learned during my internship.

What has been your work experience before Payable?

Prior to my experience at Payable, whilst I had completed various small web-dev projects in my own time, I was left without a clear view of what software engineering would be like at a real company. I decided to seek an internship not only to learn more about the tools and tech skills required to succeed in a similar job, but also to gain an insight into the workflow. Specifically I was interested in the collaborative aspect of the position - not only between software engineers, but product designers too.

What was your internship project?

During my internship I was tasked with creating a ROI calculator for the landing page of the website. The goal of the ROI Calculator was to demonstrate how much time finance teams could save by simply automating their manual processes. It used a simple calculation in the back end and a design flow to capture the details that were driving the equation.

To begin with I was introduced to Figma, which I had never used (having not been much of a designer myself) and Linear’s ticketing system for dividing up tasks and keeping track of their progress. I was presented with the amazing designs carefully created by the team as well as the list of tickets created for me that I would be working on through the following weeks.

I would say that the first ticket was the most difficult; I had used GitHub in the past solely for uploading my own projects, and I wasn’t entirely sure how the system of branching, reviewing and sending pull requests worked, so getting used to that was a challenge. Additionally, understanding the structure of the existing codebase as well as the best practices for my code was a lot different to my usual (admittedly unorganised!) programs. However, with the extremely helpful guidance of my engineering manager Matt, I gained an intuition for the process and an understanding of the style of code that I should be creating.

What did you learn during your internship at Payable?

Having received lots of positive feedback and having acted upon areas for improvement, I now feel confident that my work is of high quality and of a professional standard. Learning to use new technologies on the tech stack - my favourite being Chakra - and improving my knowledge of existing ones - especially GitHub - sets me up for employment in the future; not only in terms of skills and experience, but in terms of my own conviction.

Yet the most important skills I learned from this internship were those of collaboration. As it was my first time doing an internship at a company, I was extremely nervous in my first few meetings. I was especially happy with how welcoming everybody was - throughout the internship, I gained confidence asking questions of clarification and proposing changes to the design, and by the end of the process I felt comfortable demonstrating the finished product in front of the entire team.

What's next for you?

Going into my final year of high school, I have a newfound drive to achieve the highest grades possible in my A-levels; I feel extremely confident that a degree in Computer Science is the one for me. I enjoyed the internship very much - not just because the field suits my skills and personality, but because of how kind the team at Payable was to allow me this opportunity and receive me so amicably. This will be an experience I will never forget!

Announcements

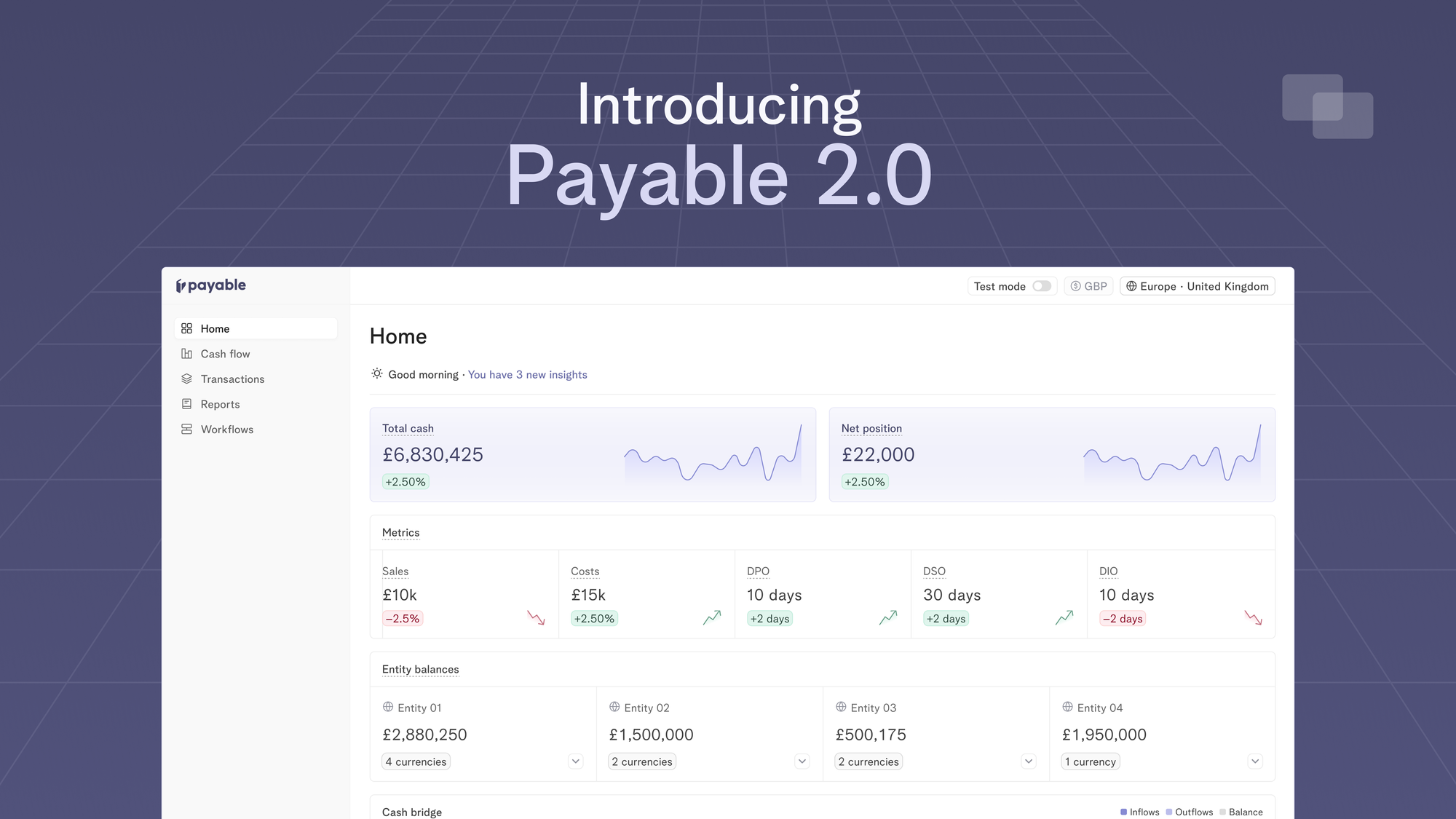

Introducing Payable 2.0 - one platform to optimise working capital, make fast liquidity decisions and move your cash metrics in real-time

13 Apr 2024

Today, we’re excited to launch Payable 2.0 which is our evolution to a more connected, intelligent and automated platform for finance teams to track their cash flows in real-time.

Cash Management

Mastering 13-week direct cash flow forecasts

26 Mar 2024

Knowing how your cash flow will behave in the future is crucial for the success and sustainability of any company. One way to achieve this is through the use of a 13-week direct cash flow forecast, which provides a detailed projection of a company's inflows and outflows over a specific time period.