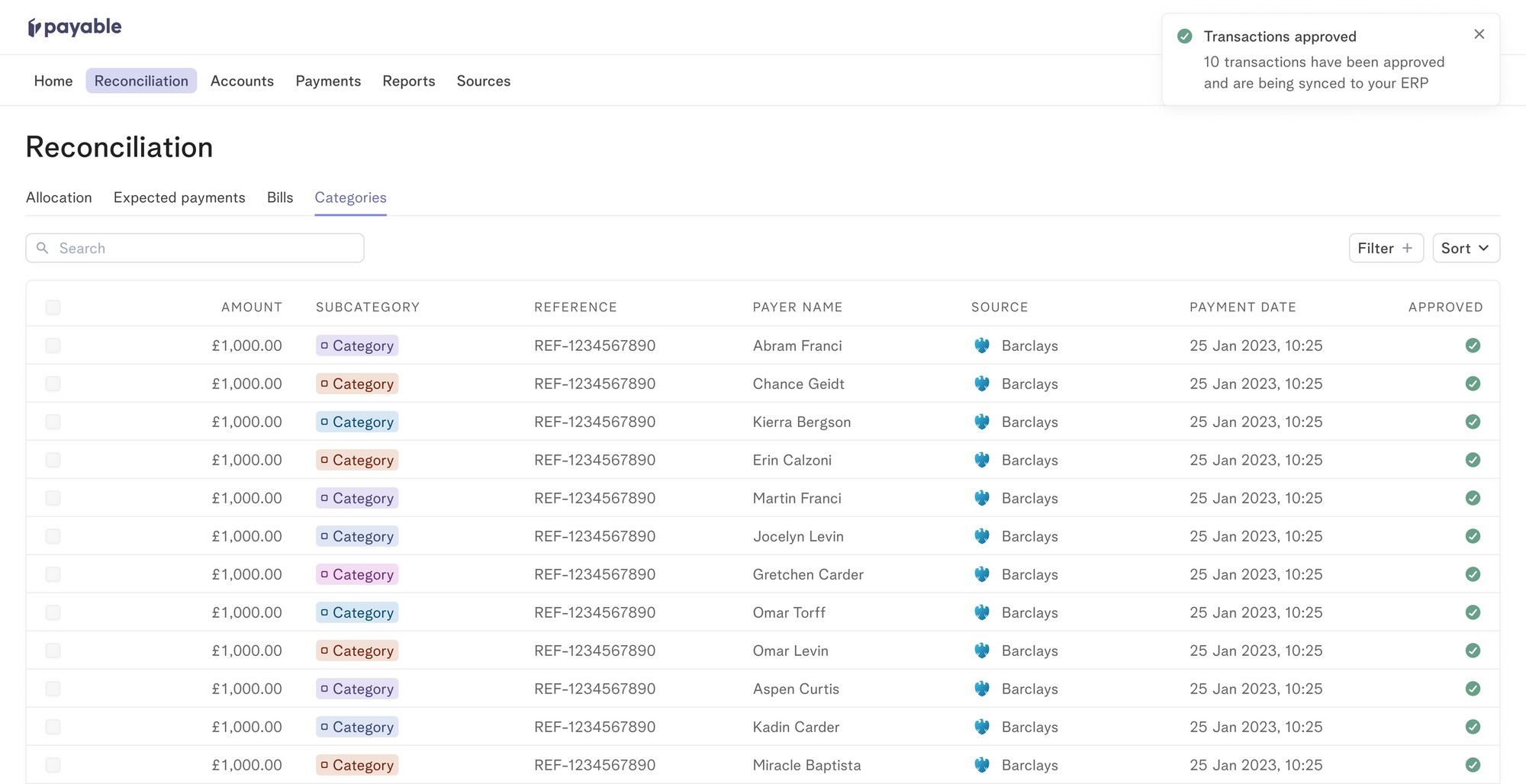

You can now import your chart of accounts from your ERP or accounting tools directly into Payable and categorise all your bank transactions ensuring your financial records are accurate and comprehensive. A category in Payable represents a like-for-like account from your chart of accounts.

You can easily assign each bank transaction to its appropriate category and have better visibility of where your money goes. Payable will sync your transactions and allocated categories back with your ERP and accounting system to keep all your tools and data up to date and in sync.

Here’s how it works:

- Transaction matching

We pull all your bank transactions, normalise them, and then auto-detect which one of your categories they belong to using identifiers like the transaction name, reference, or value. - Transaction allocation

You can assign transactions in bulk to category accounts, which align with your chart of accounts. The process is designed for ease, allowing multiple transactions to be assigned in a single flow. - Transaction sync

Once you have approved and completed your reconciliation, we will write the data back into your ERP or accounting system, keeping all your records up to date and in sync.

Shipped by Carole Olivier, Maddie Carter-Smith, Matt McCherry, Sebastien Kovacs, and Nick Godsland